Focus

shifts to demand

Focus

shifts to demand

After realising that austerity was not working, the government, with the IMF's

blessing, changed tack and decided that deficit spending was one of the few options

to stimulate demand. Soonruth Bunyamanee and Wichit Sirithaveeporn report

Economic policies at the beginning of 1998 maintained

a priority on restoring external balance, stemming capital outflows and reviving

confidence in the baht.

The economic reform programme under the International Monetary Fund, started five months earlier in August 1997, had failed to rebuild investor confidence as initially expected.

While analysts welcomed the return of Chuan Leekpai and the Democrats' respected economic team to power, few expected a rapid turnaround, given the extent of the economic damage wrought over a decade of imprudent growth, public mismanagement and weak corporate governance.

Capital outflows continued unchecked in the first quarter, as international investors and financial institutions called back loans and sought to limit country and regional exposures.

The baht

remained under pressure, weighed down by massive forward obligations held by the

Bank of Thailand. Regulators had taken out a range of currency swaps and forward

contracts the year earlier in a misguided, and ultimately failed, attempt to defend

the baht against international speculators and hedge funds.

The baht

remained under pressure, weighed down by massive forward obligations held by the

Bank of Thailand. Regulators had taken out a range of currency swaps and forward

contracts the year earlier in a misguided, and ultimately failed, attempt to defend

the baht against international speculators and hedge funds.

Growing political and economic uncertainty in the region also boded ill for the Thai economy in the early part of the year. South Korea had just avoided bankruptcy in late December and early January by securing a massive debt restructuring deal with foreign banks and a bailout package with the IMF.

Tensions in Indonesia, meanwhile, led many investors to pull out of the region, helping to propel the baht over 50 to the US dollar in late January and early February.

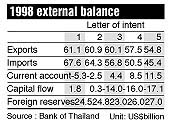

Monetary and fiscal policies were kept tight to foster external adjustment. The

IMF second letter of intent revised the 1998 projected current account deficit to

3.8% of gross domestic product from 5%.

The change reflected expectations of shrinking private demand due to tight monetary policy, needed to help support the baht and reverse capital flight. Rebuilding the country's foreign reserves was a priority to help regain investor confidence.

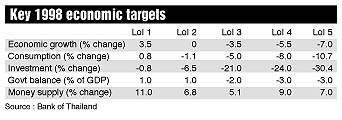

Fiscal policies in the beginning of the year also emphasised prudence and discipline. The IMF, mindful of the hidden future costs required for financial sector restructuring, had called for a budget surplus of 1% of gross domestic product for fiscal 1998, following a deficit of 1.6% of GDP in the previous fiscal year.

The surplus target forced the government to slash spending by 180 billion baht from the previous spending plan of 982 billion for fiscal 1998, which ended on September 30 this year.

But tight fiscal and monetary policies, while helping restore some balance in external accounts, wrought havoc on the domestic economy. Unforeseen local and external factors, coupled with the IMF's stringent restructuring prescription, touched off a liquidity squeeze throughout the economy.

Short-term

interest rates jumped sharply higher, leading to an inverted yield curve. Weak finance

companies and commercial banks continued to turn to the central bank's Financial

Institutions Development Fund for liquidity support.

Short-term

interest rates jumped sharply higher, leading to an inverted yield curve. Weak finance

companies and commercial banks continued to turn to the central bank's Financial

Institutions Development Fund for liquidity support.

Larger banks and foreign institutions, beneficiaries of the flight to quality over 1997, lent risk-free to the central bank through the money market, squeezing liquidity further from the real sector.

A credit slowdown was inevitable, given deteriorating asset quality and prospects for the economy overall.

Companies with state contracts and concessions also fell into liquidity difficulties as public agencies held back payments in a bid to remain within the government's austerity guidelines.

Meanwhile, Indonesia was wracked by riots, touched off by public protests against food shortages and higher prices stemming from IMF calls for the government to slash subsidy programmes.

The Indonesian rupiah nosedived, falling more than 300% against the US dollar. Investors' nerves were further upset by rumours than Indonesia was considering implementing capital controls and a possible currency board system, despite resistance from the IMF and major G-7 countries.

Regional turmoil dashed any hopes that Thailand would achieve a rapid rebound. As a result, policymakers and the IMF agreed to relax fiscal policies for the third letter of intent, effective from February through May.

Instead of a 1% surplus target, the 1998 budget would instead aim at a deficit of no more than 2% of GDP.

But no real stimulus programmes were outlined in the third letter. Instead, the eased fiscal target reflected more the reality that public revenues would be sharply lower because of falling tax receipts from the private sector.

Tight monetary policies under the third letter were maintained. The IMF was steadfast in its belief that monetary discipline was needed to restrain outflows and stabilise the baht, at least for the remainder of the first half.

A conservative approach was particularly needed, policymakers argued, in light of growing market volatility in Asia and other emerging markets.

But high interest rates and only a slight easing in fiscal policies did little to prevent the slide in domestic economic activity. Production and manufacturing indices slid to historical lows.

Non-performing loans in the banking sector, meanwhile, jumped sharply as corporate borrowers were squeezed between higher debt-servicing costs and expenses and shrinking markets.

Imports all but collapsed, falling nearly 40% in US dollar terms in April and May compared with the year before. Consumers, wary of growing job insecurity, cut back sharply on new purchases of electronic goods, automobiles and household appliances.

The current account, meanwhile, jumped sharply, with net inflows averaging $1 billion per month over the first half. The inflows helped stabilise the baht in a range of 40-42 to the dollar for the second quarter, while falling demand and depressed world commodities prices helped restrain inflation.

Toward the end of the first half, policymakers could point to several promising signs that the economic collapse, if not over, was at least easing.

Bangkok Bank and Thai Farmers Bank raised a total $1.8 billion in new capital through overseas share placements in the second quarter. The government was able to raise other funds through loans from Japan and the World Bank.

|

| Bangkok Bank of Commerce employees protest closing down of the bank and the planned merger with state-run Krung Thai Bank on September 28. Poster reads: Only 63 days left before we will be jobless. |

Under the fourth letter of intent, signed in late May and running through August, the fiscal deficit target was increased to 3% of GDP from 2%. Money supply growth for the year was increased to 9% from the 5.1% target set out previously.

Money market interest rates also began to ease. As depositor confidence returned to the financial system, demand for liquidity from the Financial Institutions Development Fund dropped.

The government also had approved the issue of 500 billion baht in state bonds to refinance the more than one trillion baht in liabilities of the Fund.

Interest on the liabilities would be paid through the fiscal budget, while principal payments would be made from expected proceeds of state enterprise privatisation.

Bond sales began in late June, with a one-year issue with a coupon of 12.75% and an accepted yield of 15%. The central bank said it would issue bonds at various maturities of up to 10 years, to help build a range of benchmarks for private issuers in the future.

Corporate debt restructuring was a key element in the fourth letter of intent. While liquidity was gradually returning to the system, the vast majority of corporate Thailand remained all but insolvent. Debt-to-equity ratios for listed companies soared to 4-5 times.

And although the stronger baht would mitigate some of the losses taken following the float in July 1997, borrowers still faced 30% higher costs on their unhedged foreign debt.

The central bank established a committee to help coordinate debt restructuring for the largest companies in Thailand. The committee included representatives of local and foreign banks, the Federation of Thai Industries and the Board of Trade.

The highlight of the fifth letter of intent, running from August to November, was the government's financial restructuring programme, announced by authorities on August 14.

Regulators seized five finance companies and two small banks, Union Bank and Laem Thong Bank. Siam City Bank and Bangkok Metropolitan Bank, nationalised earlier in the year, were to be privatised by mid-1999.

First Bangkok City Bank and the performing assets of Bangkok Bank of Commerce, meanwhile, would be merged with state-owned Krung Thai Bank, which would be recapitalised in return by the central bank.

But of greatest interest was a 300-billion-baht recapitalisation programme for the remaining banks and finance companies.

One option will allow financial institutions to issue preferred shares, increasing tier-one capital, in return for 10-year government bonds. To limit moral hazard (the tendency to take more risks when one is covered by various guarantees), applicants must first implement stringent loan classification and provisioning requirements originally set to be phased in through 2000.

The second option allows financial institutions to issue new subordinated debentures, raising tier-two capital, in return for government bonds. State capital is tied to new lending and losses taken by firms through corporate debt restructuring.

Still, it became increasingly evident over the third quarter that the 3% fiscal deficit target of the fourth letter to the IMF was insufficient to stem the recession.

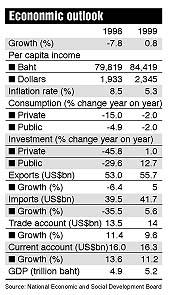

The fifth letter now projected an economic contraction for 1998 of 8% of GDP, versus 5.5% forecast in the previous letter.

But the programme called for no increase in fiscal spending. The IMF maintained that the economy would bottom out by the end of 1998, based on increasingly stable inflation, production and investment figures.

The fifth letter did allow considerable easing of monetary policies, and regulators urged commercial banks to lower lending rates to close the spread with deposit rates, which had fallen sharply since the beginning of the year.

But while interbank rates had fallen to as low as 3% by the third quarter, the role of banks and finance companies as financial intermediaries remained significantly distorted.

Non-performing loans had jumped to around 40% of total outstanding credit in the system. With the pace of recapitalisation lagging, most institutions had frozen new loans or were scaling down their portfolios to minimise the costs of setting aside loan-loss provisions.

Any new credit granted was primarily transactional, short-term loans, such as trade finance --little surprise given excess production capacity of 50% and corporate Thailand still all but insolvent.

The government and the IMF, in the sixth letter of intent, acknowledged that recovery would likely be delayed until mid-1999 at the earliest.

|

| Finance Minister Tarrin Nimmanhaeminda explains the banking reform package at a press conference chaired by Prime Minister Chuan Leekpai in August. |

Aimed at improving social welfare and economic-stimulus programmes, the deficit spending is hoped to result in economic growth in 1999 of 1%.

But in implementing stimulus measures, the government had to be wary of stoking inflationary pressure, noted Pisit Leeahtam, deputy finance minister.

A rapid increase in demand had to be met with sufficient production capacity; otherwise the result could be a sharp jump in imports and prices.

Dr Pisit said controlling prices was a priority, given the decreases in purchasing power. Inflation of 2-3% was considered high enough.

"If we could go back in time, and had implemented fiscal measures from the start, the situation would be vastly different than it is now," he said.

"If we didn't increase value-added taxes and cut government spending, right now we would have been able to control the economic downturn much better."

But it wasn't until March that the IMF agreed to allow the government to run a deficit, Dr Pisit said. By that time, the economy was caught in a liquidity trap, worsening the downturn.

In any case, policymakers hope existing measures will prove sufficient for braking the downturn and leading a resurgence in consumer and investor confidence.

For fiscal 1999, the government will focus on small projects to create employment, with speedy implementation. The Finance Ministry expects disbursements for the fiscal year to reach 90% of planned expenditures, compared with typical rates of 80% in previous years.

An independent watchdog commission will be established to oversee individual ministries and guard against fraud, corruption and misappropriation of state funds.

To ease the social impact of the downturn, the government has borrowed $150 million to provide grants and loans to community development projects and investment programmes.

Another change in fiscal policies has been a reduction in tied-over budget projects, for which spending commitments span several years.

The Finance Ministry says it will fund the deficit through existing treasury reserves, foreign loans and the issue of treasury bills and bonds in the local market.