Subsidies: Are political, economic, and social consequences justifiable?

Johan Olsson

International Trade and Finance

Hawaii Pacific University

December, 8, 1994

Subsidies were the most heavily discussed issue at the last round of trade talks in the General Agreement of Tariffs and Trade (GATT) forum in Uruguay. It is in most national government's best interest to promote certain domestic industries by paying subsidies to domestic producers or exporters. Subsidies take the form of cash disbursements, tax exemptions, preferential exchange rates, governmental contracts with special privileges, and other favorable treatment. The key issue in the debate regarding subsidies is based on that subsidized products can move in international trade a equalize/nullify existing trade tariffs in a particular importing economy. Direct exports subsidies for manufactured goods are prohibited by GATT, but most industrialized nations do not obey to the treaty. I believe that the economic, political, and social consequences of subsidies can generally not be justified. However, arguments such as the protection of national security and the protection of infant industry can, in some cases, justify the implementation of subsidies in certain industries and nations.

ECONOMIC ASPECTS:

One of the most important argument against subsides is based on economic theory. Subsidies and price supports have existed for centuries, but now they are incredibly wasteful and completely outmoded for world markets. Subsidies, fostering the protection of domestic industries have a negative effect on employment, the budget deficit, and other economic aspect. The economic implications of subsidies are significant. Government subsidies given to the private industry usually end up hurting the economy. A subsidy sponsors unprofitable business enterprises and often favors one firm over another. Therefore, subsidies effectively interferes with the concept of a free market economy.1 In addition, government support to import-threatened industries seems to contain the growth of bilateral trade between developed and developing nations. Government subsides revitalize the import-threatened industries through sustained investments in capital intensive assets, thus creating permanent barriers to bilateral trade.Naturally, sponsoring unprofitable and profitable industries by subsidies requires high government expenditure. Subsides are most commonly funded by revenues derived from trade tariffs and internal federal income taxes. It is highly questionable if government expenditure on subsidies can be justified by the increase in exports, which normally cause an increase in the Gross Domestic Product. Furthermore, critics argue that leniency on subsidy rules burdens taxpayers and disrupts trade and investment.

Moreover, many domestic subsidies influence imports and exports. This influence interferes with theory Absolute/comparative advantage of trade. This theory states that if one country is more efficient in production of one particular good, both nations will benefit if they utilize the industries which are the most efficient. The comparative advantage situation makes countries trade with each other. By the effective use of subsidies, the comparative advantage that one nation has on comparison to another will be equalized by the amount of subsidies. For instance, if EU has a comparative advantage in the production of steel over the USA, and that USA has a comparative advantage in the production of aircraft's over EU, both trade blocs should benefit if the US would purchase steel from the EU, and the EU would purchase aircraft's from the USA. However, governmental subsides are presently giving both of the trading partners an equal comparative advantage, which actually is folly, since subsidy funds come directly from the domestic budgets. An excellent example how subsidies can impact on the global market economy is demonstrated in the following case; US and EU disputes over the subsidies of steel production.

Subsidies provided by the European Commission and its predecessor, the European Coal and Steel Community has kept poorly run steel plants operation, creating enormous over-capacity. The commission is now offering continued subsidies in exchange for production cutbacks. The market for European steel has in recent years been hurt by falling prices and US anti-dumping duties.2 The British industry is at an even greater disadvantage because many of its European competitors receive state subsides, which has led to over capacity and a price war. The European steel industry will likely receive a large aid package from the European Union (EU) worth up to $1.1 billion between 1994-1996.3 This aid is deemed necessary because of excess capacity and to prepare for plant closures and layoffs.

The European union is now trying to get its individual members to reduce their subsidies to business so that weaker economies are not at an unfair disadvantage. Currently, Europe's four biggest economies in Italy, Germany, France and Britain have the most state aid to business.4 However, there are still strong differences between the US and the EU. US and EU negotiators pursued hard-lined positions on the proposed elimination of steel subsidies.5 The US has repeatedly denied EU demands to establish a list of "non-touchable" steel subsidies.

POLITICAL ASPECTS:

The power of World politics has in recent years moved from military forces to economic power. The implementation of subsidies on trade of products and services are presently constituting a major threat to international political stability, especially between the USA and the European Union. The trend of recent GATT rounds is that they have become longer and more complex in nature. International trade disputes are today more difficult to solve than even before. The formation of free trade areas in recent years has also contributed to international tension. Subsidizing of major multinational industries creates major implications to the domestic markets. For instance, small domestic producers may not be able to meet the competitive position due to lack of funding.Historically, GATT has been able to resolve several trade issues. On November 20, 1992, representatives from the US and the EU reached an agreement to decrease EU agricultural subsidies to oilseed farmers. This agreement remover a significant obstacle to world trade negotiations in Uruguay. Many times, GATT talks have been suspended over the issue of EU farm subsidies, which US trade negotiators oppose. However, both EU and US officials agree that the differences are minor, and could be resolved if wither party displayed a willingness to compromise.

According to an agreement between the US and EU negotiated under the Uruguay GATT talks in 1992, government subsides should be limited to 33% of development costs or 4% of company annual sales and must be repaid within 17 years. Proposed new GATT subsidy rules that allow governments to subsidize 75% of research costs and 50% for development costs, would surely benefit business entities engaged in heavy research and development activities, such as the aircraft industry.6

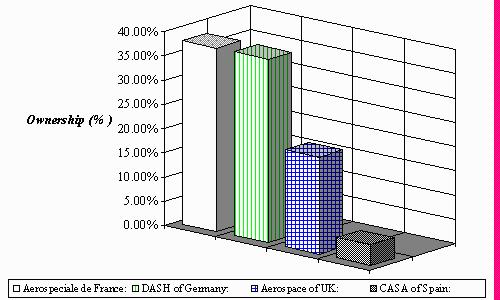

An interesting case on how subsiding of key industries can cause political tension between nations is American Boeing Company, versus European Airbus Industries. Before 1960, the global aircraft industry was heavily dominated by US manufacturers. At this time, the ECC believed that the time had come to an end on the American monopoly for large aircraft's. As a response to American dominance on the global aircraft market, the four nation consortium, Airbus industries was formed. Germany, France, the United Kingdom, and Spain gathered their resources in order to create a line of planes that would become Boeing's main competitor (refer to graph #1).

Each company in the Airbus consortium builds components to the aircraft's. The percent share of the company represent both composition of component parts and ownership. Each company keeps its accounts confidential. Airbus is today emerging as an important rival to Boeing. Various types of Airbus 300's have been sold and over 3000 have been ordered. Airbus has captured about 33% of the World's aircraft market.7 Started 20 years ago with a tiny little firm. This company was heavy subsidized by the four governments from the very beginning. Boeing Company believes that Airbus is a tax supported entity engaged in unfair and predatory trade. On the other hand, Boeing is provided by subsidies from the US government in the form of research and development. Recently, the US International Trade Commission claimed that Airbus Industrie's success was due to government support. Contra this argument, Airbus says government officials do not act on their behalf.

Graph #1: Composition of the Airbus Industrie Consortium:

The aerospace industry's future rests, to a large extent, with government trade bodies, including the GATT organization. It is today unclear whether the aerospace industry could survive without the governmental support it currently enjoys. US and EU leaders have not yet reached a compromise with regards to bilateral accords defining subsides for civil aircraft development under the GATT negotiations in Uruguay.8 The Clinton administration appears to be favorable to government support for Boeing Company and McDonnell Douglas Corporation. According to Airbus Industrie officials, the US has not obeyed to the 1992 agreement between the US and the EU to limit government subsides for the aircraft industry.9 According to Airbus, the US provides abbey $1 billion in indirect spending through the Pentagon and the National Aeronautics & Space Administration (NASA) in 1993. In contrast, Airbus has only received #300 million in government subsides in the same year.10

This case does not only demonstrate the political implications of trade subsidies, but also the failure of the Paraguay Rounds in GATT, and the case is an excellent example of modern economic "warfare". Since the global economic environment is getting increasingly more competitive, non tariff trade barriers such as subsidies will be heavily discussed. GATT talks have been more aggressive in recent years, and the move to turn GATT into the World Trade Organization in January 1995, will decrease US dominance in international trade disputes. It is highly questionable if WTO will be able to resolve international trade disputes any better than GATT.

Another contemporary issues concerns the subsidies of Japanese banks, which now enjoy a significant competitive advantage over their US counterparts due to government subsidies. Japanese banks receive cheaper funding and are subject to more relaxed capital requirements.11 This competitive advantage furnished by the Japanese government makes it difficult for foreign banks to take advantage of the booming Japanese economy, and penetrate Japanese financial markets.

SOCIAL ASPECTS.

The dilemma of social implications of subsidies include all of the following; subsidized are a major obstacle to the free market economy, lower quality goods and services and finally domestic social consent. It is the widespread belief that a free market economy creates innovativeness and superior products. The strife of spirited entrepreneurs creates a dynamic economy, where only the best adopted to a particular market segment survives. Subsidies, however, creates a disequilibrium in certain market segments.12 By supporting certain industries, a favorable competitive situation is created for certain industries, and others are left competing on their own. Such government interference could, in the long-term perspective, create several extremely large global industries.Furthermore, since subsides present a major obstacle to the free market economy, they may impact on the quality of products and services produced by subsidized industries. Many cases, subsidies have practically illuminated foreign competition in the domestic market.13 The power of the buyers will decrease, since there will be less competition in the marketplace. It could therefore be possible for the subsidized industry to offer its customers products and services of less quality. It is the widespread belief that more stringent competitive forces tend to enhance quality of products and services.

ARGUMENTS IN FAVOR OF SUBSIDIES.

There are two basic arguments that I believe can justify the implementation of subsidies in a domestic market. First, the infant industry argument, and second, the national security argument. GATT also recognizes these two arguments as valid excuses for governments to implement subsidies, however, it is difficult to draw the line between what can be defined as an infant industry, and what a valid national security argument is.First, the infant industry argument is most commonly used in less industrialized nations. It argues that a new national industry has to be protected from foreign competition during its "infant" stage. The industry should be able to gain a significant market share within the domestic market, before subsidies are abolished. When used properly, I believe that this argument is valid. However, in Malaysia, "Proton" (the nation's first national car industry), has been heavily subsidized for over 8 years. Presently, the industry dominates 43 percent of the domestic market, and cars are being exported to various nations. The Malaysian government still believe that this is an "infant" industry, and it is continuing to subsidize the company. I believe that is stretching the argument a bit too far. I do not think that the infant industry argument is valid by the time that a protected industry is able to penetrate foreign market.

Secondly, the national security argument has been heavily discussed in recent GATT forums. This argument argues that due to national security measures, certain domestic industries must be able to survive foreign competition and continue to operate inside the domestic market. For instance, many nations, believes that its domestic food production is necessary for maintaining national security measures. In case of war, disruptions in food supply may be inconvenient. Many nations subsidizes their agricultural sectors. The consumers end-up paying higher prices for agricultural products in those nations, since the foreign producers who are enjoying a comparative advantage in the production of agricultural products are unable to sell their goods in the subsidized domestic market.14

BIBLIOGRAPHY.

1. "Hot blast: European steel" The Economist November 21 1992 (79)

2. "Aid Addicts: European competition policy." The Economist August 8 1992 (61)

3. "Belated bonhomie." The Economist October 2 1993 (50)

4. "Down the drain." The Economist December 11 1993 (73)

5. "Steel woes." The Economist February 19 1994 (18)

6. "Subsidies give Japan banks competitive edge." Journal of commerce and Commercial April 7 1994 (2A)

7. "They reap as they snow." The Economist December 12 1993 (5-9)

8. Bernard, Bruce. "EC officials says Airbus is US scapegoat." Journal of Commerce and Commercial March 4 1993 (28)

9. Bernard, Bruce. "EU sets air subsidies rule book, risking a political controversy." Journal of Commerce and Commercial May 17 1994 (2B)

10. Bernard, Bruce. "EU suspects US of violating bilateral aircraft subsidy accord." Journal of Commerce and Commercial March 18 1993 (3A)

11. Fleming, Heather M. "Dairy price supports to be weakened." Quarterly Weekly Report July 23 1994 (2007)

12. Illingworth, Montieth M. "Honeymoon with European definitely over" Journal of Commerce and Commercial. December 10 1992 (7A)

13. Kutter, Robert. "The big snag in the global economy." Business Week August 1 1994 (16)

14. Maidment, Paul "Does Airbus Cheat?" Newsweek March 8 1993 (44)

15. Patel, Tara. "Airbus chief says US violating pact on air subsides." Journal of Commerce and Commercial June 11 1993 (1A)

16. Rudolph, Barbara "The grapes of wrath." Time November 23 1992 (50)

17. Shaw, Russel. "Too many hands down on the farm?" Insight on the News April 4 1994 (16-20)

18. Wood, Nancy. "Taking care of business: should governments bankroll the private sector?" Maclean's September 6 1993 (17)

19. Zerocostas, John. "Global steel talks bogged down by hardening of US. EU positions." Journal of Commerce and Commercial June 27 1994 (3A)

1Kutter, Robert. "The big snag in the global economy." Business Week August 1 1994 (16)

2"Hot blast: European steel" The Economist November 21 1992 (79)

3"Hot blast: European steel" The Economist November 21 1992 (79)

4"Aid Addicts: European competition policy." The Economist August 8 1992 (61)

5Zerocostas, John. "Global steel talks bogged down by hardening of US. EU positions." Journal of Commerce and Commerical June 27 1994 (3A)

6Bernard, Bruce. "EU sets air subsidies rule book, risking a political controversy." Journal of Commerce and Commerical May 17 1994 (2B)

7Maidment, Paul "Does Airbus Cheat?" Newsweek March 8 1993 (44)

8Illingworth, Montieth M. "Honeymoon with European definitely over" Journal of Commerce and Commercial. December 10 1992 (7A)

9Bernard, Bruce. "EU suspects US of violating bilateral aircraft subsidy accord." Journal of Commerce and Commerical March 18 1993 (3A)

10Bernard, Bruce. "EC officials says Airbus is US scapegoat." Journal of Commerce and Commercial March 4 1993 (28)

11"Subsidies give Japan banks competitive edge." Journal of commerce and Commerical April 7 1994 (2A)

12Wood, Nancy. "Taking care of business: should governments bankroll the private sector?" Maclean's September 6 1993 (17)

13Wood, Nancy. "Taking care of business: should governments bankroll the private sector?" Maclean's September 6 1993 (17)

14"Agro Money." The Economist September 25 1993 (86)