The financial crisis, which resulted in a weaker ringgit and a higher domestic inflation rate, has made Malaysians poorer. Per capita Gross National Income will fall to an estimated RM11,817 this year and further to RM11,626 in 1999, from RM12,051 in 1997.

In terms of purchasing power parity, per capita income will fall 32 per cent to US$8,196 this year from US$12,043 last year, according to the 1998/99 Economic Report released by the Treasury last week.

The question is, have we seen the worst? The consensus seems to be yes, the economy has hit bottom but how well it recovers in 1999 will hinge on two major factors. One, the speed and the extent of the implementation of fiscal and monetary measures to revitalise growth and two, developments on the global front, particularly in Japan and the US.

Still, the Treasury report expects a mild recovery in gross domestic product (GDP) in 1999. Fiscal stimulus and monetary easing should induce some recovery in domestic spending but continued volatility in the international financial environment combined with sluggish and, in some cases, negative growth among Malaysia's major trading partners, are expected to weigh down growth prospects.

The Treasury's projection is for GDP to grow by 1 per cent next year with inflation, measured by the Consumer Price Index (CPI) at 3.5 per cent, down from 5.2 per cent in 1998. The CPI forecast is based on a fixed exchange rate for the ringgit at RM3.80 vis a vis the US dollar.

On the demand side, growth is expected to emanate domestically. On the supply side, the manufacturing sector is expected to spearhead growth.

Still, a 1 percent GDP extension is no easy task, as it means that the economy will have to grow by atleast 5.8% in 1999, given that this year's GDP is projected to contract by 4.8%, 1997's growth came in at 7.7%.

Still, a 1 percent GDP extension is no easy task, as it means that the economy will have to grow by atleast 5.8% in 1999, given that this year's GDP is projected to contract by 4.8%, 1997's growth came in at 7.7%.

The economy shrank an unprecedented 2.8% in the first quarter of this year and another 6.8% in the second quarter. Unemployment is creeping up to touch 4.9% this year, against a full emplyment rate of 2.6% in 1997.

Expectations are that the series of measures implemented since early this year will begin to have impact during the second half of the year to prevent the recession from worsening further.

The Treasury's projection of a recovery in 1999 is premised on a turnaround in all sectors of the economy to positive territory except construction.

It expects manufacturing activities to grow by 1 per cent this year from a negative 5.8 per cent in 1998. Agriculture, which contracted by 5.9 per cent last year, is seen turning around to register a growth of 3.9 per cent. A catalyst is crude palm oil (CPO) output, which is estimated to improve by 7 per cent next year after contracting 8 per cent in 1998.

Construction activities are expected to contract another 8 per cent in 1999, due largely to sluggish construction starts in some segments of the property market, especially commercial buildings and higher-end condominiums.

"Excess supply of office space, retail outlets as well as high-end condominiums are not expected to be taken up fully in 1999," the report explains.

However, construction activities with regard to public works as well as infrastructure projects will get a boost from the fiscal stimulus announced by the government recently. In the pipeline for construction, the economic report says, are small infrastructure projects such as roads, bridges, railworks. There will also be continuation of bigger projects like the Light Rail Transit System, KL Sentral, Kuala Lumpur Monorail System as well as the development of the Kuantan and Tanjung Pelepas Ports.

However, construction activities with regard to public works as well as infrastructure projects will get a boost from the fiscal stimulus announced by the government recently. In the pipeline for construction, the economic report says, are small infrastructure projects such as roads, bridges, railworks. There will also be continuation of bigger projects like the Light Rail Transit System, KL Sentral, Kuala Lumpur Monorail System as well as the development of the Kuantan and Tanjung Pelepas Ports.

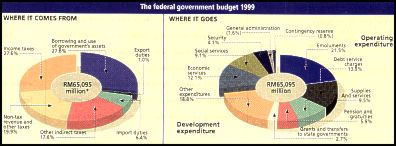

As a result of implementing the counter-cyclical fiscal measures and falling tax revenue because of the drop in economic activities, the federal government is ex-pected to post a deficit of RM16.1 billion or 6.1 per cent of gross National Product (GNP). This is the first deficit since 1993.

Although the 1999 Budget is expansionary, the government's net development expenditure will shrink by O per cent to RM 16.3 billion, from RM 18.1 billion in 1998 The Treasury explains that this is in line with the amount of resources that can be mobilised without crowding out the private sector in terms of access to financing as well as to ensure that the overall fiscal deficit is sustainable.

Despite this being the first deficit in five years, economists generally aren't overly concerned because they say the government is managing the economy in a crisis situation, unlike in the past.

Amid the gloom, there are some bright spots. With a slowdown in imports, Malaysia is expected to record an unprecedented trade surplus of RM42.7 billion this year. A smaller surplus of RM33.4 billion is seen for next year because imports are expected to rise as a result of a pick-up in economic activities.

Even though the services account will continue to be in deficit, estimated at RM19.5 billion, the current account is expected to be in the black, around RM2O billion or 7.7 per cent of GNP in 1998, for the first time since 1989. A smaller surplus of RM 11 billion is projected for 1999.

The long-term capital account of the balance of payments (BOP) is expected to record a lower net inflow of RM13.9 billion in 1998.

The basic account of the BOP, which records both the current account and the long-term capital account could register a surplus of RM33.9 billion in 1998 compared with RM4.9 billion in 1997. After taking into account the net outflow of short-term capital funds of RM3I.8 billion and revaluation gains of foreign exchange reserves of RM24.6 billion, the overall balance of payments is likey to record a surplus of RM26.8 billion.

The net external reserves held by Bank Negara by the end of this year is estimated at RM85.9 billion or US$ 22.6 billion, enough to finance 4.4 months of retained imports.