Internet Service Provider

(ISP) Business Plan

Web Solutions, Inc. (Web Solutions) is an Internet Service

Provider (ISP) based in Phoenix, Arizona. The company offers the following

services to its customers:

- Dialup and dedicated Internet access (up to 64 Kbps).

- High bandwidth Internet access (128 Kbps).

- Integrated Services Digital Network (ISDN).

- Digital Subscriber Line (DSL).

- Wireless.

- Website and virtual domain hosting.

- Server colocation.

- Network design, installation, and administration services.

- Web design (currently outsourced).

Web Solutions is a company driven to provide customers with a

complete solution to their entire current and future Internet and private

network needs. The company's customer base includes all consumers and all small-

to medium-sized businesses, including start-ups.

Web Solutions benefits from several strategic alliances by

receiving very competitive pricing on most services, allowing the company to

offer competitive pricing on its services to customers.

ISPs offer a way for people to enter the Internet. According

to International Data Corporation (IDC), an information technology research and

consulting firm located in Framingham, Massachusetts, the consumer ISP market

will expand from $10.7 billion in 1998 to $37 billion in 2003.

Competitive threats come from other ISPs located in or around

Phoenix, including the following companies: Jump.Net, Arizona.Net, EarthLink,

and Mindspring. Most competitors offer solutions for Windows, and perhaps

Macintosh, but ignore all other operating systems. With the rise of Linux and

other alternative operating systems, there is potential for Web Solutions to

surpass its competitors.

Web Solutions has a world-class management team with direct

knowledge of the industry, extensive research experience, and unique

administration skills. Its team includes Mr. Jason Williams, Mrs. Amy Williams,

and Ms. Geena James.

Projected revenues for 2000 through 2002 are $1.5 million,

$4.5 million, and $7.5 million, respectively. The company is seeking an

investment of $1.5 million. The company primarily needs capital to fund four

areas of growth in the company:

- Increase personnel to handle sales, service, and

development efforts.

- Increase marketing to assure future customers are aware of

our offerings and aggressive pricing.

- Expand our base of operations (using wholesale providers,

partnerships, and other mechanisms) to include at least the top 100 U.S.

markets for dialup and dedicated Internet access.

- Perform research and development to bring new products to

market.

The mission of Web Solutions is to provide customers with a

complete solution to all their current and future Internet and private network

needs.

Web Solutions has established a reputation for quality work

and plans to continue to enhance its image in the industry. The company seeks to

become a well-known and respected provider of advanced network solutions by:

- Increasing service offerings.

- Increasing availability and accessibility to current and

future customers.

- Creating innovative, unique, and cost-effective solutions

to problems currently faced by customers.

|

Web Solutions, Inc. is a C-class corporation,

incorporated in the State of Arizona in July, 1997. The company's

principal offices are currently located in Phoenix, AZ. All operations,

from administration to product development, take place at this leased

office location. The company plans to move to a bigger facility as it

expands and its staff grows beyond its current four full-time employees.

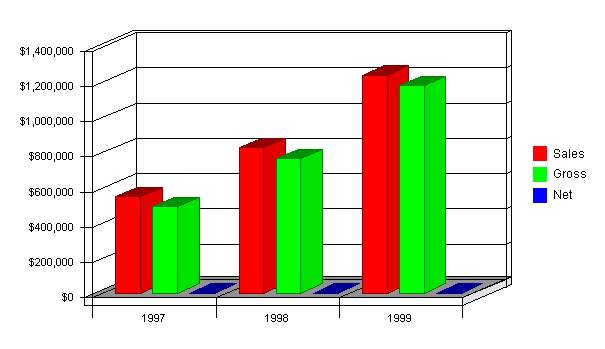

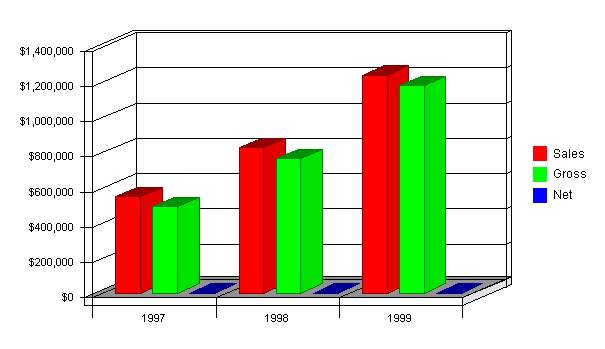

Past

Performance

Click to Enlarge

| Past

Performance |

| |

1997 |

1998 |

1999 |

| Sales |

$550,000 |

$825,000 |

$1,237,500 |

| Gross

Margin |

$490,000 |

$765,000 |

$1,177,500 |

| Gross

Margin % |

89.09% |

92.73% |

95.15% |

| Operating

Expenses |

$160,100 |

$180,100 |

$200,100 |

| Collection

Period (days) |

0 |

0 |

0 |

| Inventory

Turnover |

0.00 |

0.00 |

0.00 |

| |

|

|

|

| Balance

Sheet |

|

|

|

| Current

Assets |

1997 |

1998 |

1999 |

| Cash |

$50,050 |

$75,075 |

$112,613 |

| Accounts

Receivable |

$10,875 |

$15,400 |

$23,500 |

| Inventory |

$284,900 |

$427,350 |

$641,025 |

| Other

Current Assets |

$15,400 |

$23,100 |

$34,650 |

| Total

Current Assets |

$361,225 |

$540,925 |

$811,788 |

| Long-term

Assets |

|

|

|

| Capital

Assets |

$147,400 |

$221,100 |

$331,650 |

| Accumulated

Depreciation |

$0 |

$0 |

$0 |

| Total

Long-term Assets |

$147,400 |

$221,100 |

$331,650 |

| Total

Assets |

$508,625 |

$762,025 |

$1,143,438 |

| |

|

|

|

| Capital

and Liabilities |

|

|

|

| |

1997 |

1998 |

1999 |

| Accounts

Payable |

$50,750 |

$65,125 |

$70,688 |

| Current

Borrowing |

$40,150 |

$60,225 |

$90,338 |

| Other

Current Liabilities |

$40,150 |

$60,225 |

$90,338 |

| Subtotal

Current Liabilities |

$131,050 |

$185,575 |

$251,363 |

| |

|

|

|

| Long-term

Liabilities |

$287,100 |

$430,650 |

$645,975 |

| Total

Liabilities |

$418,150 |

$616,225 |

$897,338 |

| Paid-in

Capital |

$0 |

$0 |

$0 |

| Retained

Earnings |

$90,475 |

$145,800 |

$246,100 |

| Earnings |

$0 |

$0 |

$0 |

| Total

Capital |

$90,475 |

$145,800 |

$246,100 |

| Total

Capital and Liabilities |

$508,625 |

$762,025 |

$1,143,438 |

| |

|

|

|

| Other

Inputs |

1997 |

1998 |

1999 |

| Payment

Days |

0 |

0 |

0 |

| Sales

on Credit |

$0 |

$0 |

$0 |

| Receivables

Turnover |

0.00 |

0.00 |

0.00 |

|

Web Solutions currently delivers Internet service to dialup

and ISDN customers, and will commence to sell DSL services by February of this

year. The company currently hosts approximately 30 websites and has five

colocated servers. Additionally, the company is evaluating e-commerce software,

looking for the solution which provides the greatest flexibility while allowing

operations to remain simple for its customers.

All services are competitively price and targeted to small

"Mom-and-Pop" businesses and small office/home office (SOHO)

customers. Web Solutions feels that this market segment has largely been

neglected because of the amount of "hand-holding" required by this

segment, and the inability to pay the astronomical fees charged by many

ISPs for typically poor service and user support.

By working to simplify the creation, management, and support

of our services, the company will enable customers to perform many tasks

themselves, or automating these tasks based on the customer's stated needs. This

will make our pricing more competitive, the customers perception of service

high, and the operation as a whole more reliable and profitable.

With current hardware and facilities, the company can do the

following:

- Handle an unlimited number of dialup users.

- Handle up to 46 dedicated channels.

- Handle up to 1,000 email users.

Web Solutions is a traditional, full-service ISP, offering

dialup and dedicated Internet access, Web and virtual domain hosting, server

colocation, and network-related professional solutions (design, installation,

management, etc.). The company allows people and companies to access and publish

documents on the World Wide Web without the need to hire full-time system

administrators, costly high-speed network connections, dedicated servers, and

other similar expenses or expertise.

The company provides many of the services that customers need

to get online. The company provides both connectivity and consulting on topics

ranging from office automation to Web server planning. The company has ongoing

research and development to provide solutions to current customer issues

(e-commerce, ease-of-use features, etc.) and to develop new products and

services which enable the company to enter and compete in new markets and

attract new customers.

Web Solutions selects products which meet the following

criterion:

- Benefit to customers/company: the product must

materially benefit the customer or the company in some way. This may

manifest itself as a side benefit, an improvement on current services, or

additional revenue stream to the company.

- Cost/benefit ratio: the benefits realized must be at

least as great as the cost of implementation, production, and maintenance of

the product.

- Maintainability: the product must be maintainable by

PhoenixARIZONA.COM personnel. The company has had some experience with

products where source code and other maintenance resources are unavailable

and has had major difficulties with these restrictions. The company has a

strong preference for Open Source and similar distribution methods where

source code is available to personnel to correct problems which vendors

consider too unimportant to warrant effort on.

Web Solutions makes a concerted effort to keep customers

informed and to remedy problems in the shortest possible times. The company has

lost very few customers to technical support issues, and will continue to make

high quality support one of its primary goals.

Web Solutions offers telephone support during extended

business hours (8 a.m. to 8 p.m.) and has an on-call pager for emergencies

(network-down and server-down situations). In the future, the company plans to

implement a 24/7 network operations center (NOC) and a toll-free technical

support phone number.

When the voice/video/data (VVD) product goes into production,

the company plans to have constant monitoring of network connectivity and take

preemptive measures to solve developing problems before the customer even

notices them. For instance, if it is determined that there is a failing

component on the customer's premise equipment, it would trigger a call to the

customer and the scheduling of a replacement part before the customer even

realizes that the problem exists.

Currently, all products are implementations of Open Source

products. The groupware product will be based upon OpenDesk.com's software,

which is available under an Open Source license. Web Solutions will be extending

the functionality of this product, and release those changes back to the

development community.

With the VVD product, the company will have to design and

manufacture custom equipment for customers to receive the data and convert it to

video or voice.

Currently, the company has no products to return. The

company's usage policy states that it will refund a portion of the customers'

monthly access fee if there are extended network outages due to events within

our control.

The company gives technical advice to pre-sales customers and

technical support is offered for all purchases by the customer. These

services are offered by Web Solutions at no cost to our clientele.

Free (advertiser supported) back-office service with email,

file sharing, calendaring/scheduling, and other applications are options for

future services from Web Solutions. This would allow groups (both for-profit and

nonprofit) to have the collaboration enjoyed by major corporations with

multimillion-dollar management information systems (MIS) budgets for little or

no cost. It also would produce an avenue through which to offer future free and

pay services.

Web Solutions plans to have the initial launch of the

back-office product by March 31st. The company currently has a potential

customer (a local radio station) who wishes to privately brand this product and

offer it to their customers.

Web Solutions is in the process of researching a future

service of integrated voice, video, and data over high speed TCP/IP network

connections (DSL, etc.) so as to merge the traditional telephone, cable, and ISP

functionalilities, extend them, and affordably offer them to consumers. This

product would compete directly with traditional cable and telephone companies,

and provide new and innovative revenue streams. Current plans for this product

are to price the consumer product very aggressively and take the profit from

secondary services such as advertising. Web Solutions plans to have a working

prototype of the server and clients needed for the VVD product by October 1,

2000, and a limited launch by March 1, 2001.

The topics which follow discuss our customers, our

competitors, and conditions within our industry. The Market Analysis data found

in the following table and chart is taken from the 1997 U.S. Census.

Market

Analysis (Pie)

Click to Enlarge

| Market

Analysis |

| Potential

Customers |

Growth |

2000 |

2001 |

2002 |

2003 |

2004 |

CAGR |

| Household

Consumers |

10% |

101,041,000 |

111,044,059 |

122,037,421 |

134,119,126 |

147,396,919 |

9.90% |

| Small

Office/Home Office |

3% |

16,963,070 |

17,404,110 |

17,856,617 |

18,320,889 |

18,797,232 |

2.60% |

| Total |

8.94% |

118,004,070 |

128,448,169 |

139,894,038 |

152,440,015 |

166,194,151 |

8.94% |

The company's customer base includes all consumers and all

small- to medium-sized businesses, including start-ups. The company plans to

concentrate on SOHO clients, as these are perfect targets for our new high-speed

offerings, and hold the greatest growth potential for the company. Web Solutions

feels that these market segments have special pricing and service needs, and

make more dedicated, reliable customers.

The following sub-topics look at the size and concentration of

businesses in this group, the way services are bought and sold, and specific

competitors.

The company is competing in the low-cost Internet access and

website hosting niche of the industry. The industry is moving in the direction

of a fusion of VVD services over a single common media (ref. The AOL-Time/Warner

merger). This is where all media players must move in order to compete in the

coming decade.

The alternative is to be a content provider. This is a less

desirable position as it leaves the company too much at the whim of the public

and forces the company to renew its efforts continuously to provide usable

content.

The ISP industry has begun the process of specialization. Many

companies who began by filling all needs (as we do today) have moved into areas

which utilize their strengths. These specializations include:

- Colocation ("Server Hotel") facilities.

- Web hosting.

- Dialup access.

- Content provision.

Additionally, there are a few new markets emerging, such as

Applications Service Providers.

- Access services

ISPs offer a way for people to enter the Internet.

According to IDC, America Online (including subscribers to CompuServe, which

AOL acquired in September, 1997), has approximately a 43% share of the total

subscribers in the ISP segment, followed by Microsoft's MSN, and AT&T

Corporation's WorldNet. After these major players, roughly 5,000 ISPs fight

over the remainder of the market. IDC estimates that the consumer ISP market

will expand from $10.7 billion in 1998 to $37 billion in 2003.

When users access the Internet, they dial into the local

point of presence (POP) of an ISP or online service provider (OSP). ISPs

offer basic, flat-rate Internet access to customers, either through their

own networks, or through networks leased from other ISPs. Users dial into an

ISP's network through ordinary phone lines and, using a browser, access the

Web. OSPs, such as America Online, provide original content in areas such as

shopping, news groups, gaming groups, investor information, and magazines.

Access fees for both ISPs and OSPs typically range from

$19.95 to $21.95 per month for unlimited Internet use. The flat rate system

was pioneered by America Online in 1996 and has led to an explosion of

subscribers. Flat rates have also served to increase the amount of time that

users spend online, which has forced many local telephone service companies

to upgrade capacity in order to accommodate the heavy usage.

- A taxing issue

One nettlesome issue that could potentially slow the

growth of e-commerce is the taxation of goods and services. Currently, fees

paid to ISPs and OSPs are tax-free, except in a few states. Purchases,

however, are subject to the same taxes that apply to goods sold in a store

or catalog. When online purchases are made, purchasers are technically

responsible for remitting state and local taxes. The only exception occurs

when a consumer buys from a corporation with a physical presence in that

consumer's home state. In actuality, however, online shoppers rarely pay

this cyber-taxation.

While state and local governments are disturbed at this

loss of revenue--and the potential loss of immense future revenue--federal

governmental officials have adopted a hands-off policy with regard to

Internet taxation. In October, 1998, the Internet Tax Freedom Act was

passed, placing a three-year ban on any new Internet sales taxes or taxes on

ISPs. During this three-year time frame, a committee of government and

business representatives known as The Advisory Commission on Electronic

Commerce will meet to discuss a more permanent tax policy. The 19 members of

the commission include three federal officials, eight business and consumer

leaders, and eight representatives of state and local governments.

- ISPs face challenges

The rise in Internet users has proven to be a boon for

Internet service providers, which charge monthly subscription fees in return

for providing access. While business has been good for many of these ISPs, a

number of challenges threaten the long-term growth and profitability of

these companies.

- Broad access becomes more prevalent

Today, most residential Internet users gain access to the

Web via commonplace copper telephone wires. Download speeds are limited to a

maximum 56 Kbps and are often significantly slower than that, resulting in

frustration among impatient Web surfers. The lack of speed has provided an

opportunity for broadband service providers to gain market share. LLC's

RoadRunner, which provides high-speed online access, has begun to attract

users who desire more speed and are willing to pay a higher price. As of the

second quarter of 1999, cable modem users numbered over 1 million, still a

small percentage of total Internet users, but growing very rapidly.

- "Free" Internet access proves viable

While most headlines or advertisements proclaiming free

Internet service are actually a bit misleading, the impact of this business

model is starting to be felt. The most prominent and successful example of a

free ISP is in the United Kingdom, where Freeserve plc does not charge its

customers access fees. Unlike the United States, however, local calls in the

United Kingdom are billed on a per-minute basis, so heavy Internet users may

actually pay more than in the United States.

In the United States, different types of "free"

plans are being marketed. One strategy gives a subscriber free service in

exchange for having advertisements scroll constantly across his or her PC

screen. A different slant to this marketing scheme allows a consumer to earn

a free personal computer, provided that he or she signs up for a few years

of Internet service in advance.

The following is a list of services which various websites

provide:

- Destinations. Destinations are places, or websites,

located on the Internet where people can go for information, entertainment,

or commerce.

- Content providers. This type of website offers

mostly original content (like news articles) to subscribers. Some of the

major content providers include ESPN Sports Zone (a joint venture between

Infoseek Corp. and Walt Disney Co.), SportsLine USA Inc., privately held The

Motley Fool Inc., and MSNBC (a joint venture between Microsoft and NBC).

With new websites being established every day, it's difficult to come up

with a reasonable estimate for the size of this market.

- Portals. These websites tend to gather content into

one place rather than creating it themselves. Some of the major portals

include Yahoo! Inc. (1998 sales of $206 million), Infoseek Corporation ($63

million in fiscal year 1998), and Lycos Inc. ($56 million in fiscal year

1998). Although e-commerce has started to become a larger promotion of these

companies' business, portals typically rely on the sale of advertising space

to generate revenue.

According to Jupiter Communications, a market research

firm based in New York City, advertisers spent approximately $2 billion for

online ads in 1998. Jupiter believes that this number will hit $9 billion in

2002.

- Communities. Communities are similar to portals, in

that their primary revenue streams come from advertisers. Some of the major

community sites include Geocities (1998 sales of $18.4 million), now a part

of Yahoo! Xoom.com Inc. ($8.3 million), and theglobe.com Inc. ($5.5

million).

- Business-to-consumer e-commerce. Estimates for the

amount of online spending by consumers in 1998 range from $7 billion to $13

billion, with at least 25% occurring during the Christmas shopping season.

Forrester Research, an information technology research firm in Cambridge,

Massachusetts, believes that online retail spending will hit $108 billion in

2003.

Some of the major publicly traded online retailers

included Amazon.com Inc. (1998 sales of $610 million), CDnow Inc. ($98

million), barnesandnoble. com Inc. ($62 million), and Beyond.com corp. ($37

million). A variety of "real-world" companies including Gap Inc.,

Lands' End Inc., and Macy's have established retail operations on the

Internet.

- Business-to-business e-commerce. Although there are

very few pure business-to-business e-commerce firms, this segment dwarfs the

business-to-consumer sector. Forrester believes that this market, which

totaled $43 billion in 1998, should rise to $1.3 trillion by 2003.

Most companies in this category, like Cisco Systems and

Dell Computer Corporation, have other sales channels, but are increasingly

using the Internet to lower costs and reach a wider customer base. Dell

generates an estimated $30 million in sales every day via the Internet,

while Cisco estimates that it produces approximately $33 million a day in

sales through the Internet.

- Auctions. The online market for auctions is headed

by eBay Inc., (1998 revenues of $86.1 million, with $745 million of gross

merchandise sales).

- Hardware: networking equipment. The hardware sector

provides the infrastructure on which the Internet is built. Hardware

companies provide the equipment that forms the interconnections between the

networks that comprise the Internet. Their products steer traffic through a

spiderweb of routes to the correct destination. One critical piece of

networking equipment is the router, which acts as a traffic officer by

directing data to the proper destination. Another key element of the

Internet infrastructure is a remote access concentrator. Access

concentrators link employees and customers to an organization's internal

network, and link consumers to the Internet via their ISP.

Web Solutions believes that its customers choose its products

and services based on the following criteria:

- Price.

- Experience.

- Reputation.

- Service.

- Accessibility.

Competitive threats come from other ISPs, including the

following companies: Jump.Net, Arizona.Net, AOL, EarthLink, Mindspring, and

Prodigy Internet. Most of our competitors offer solutions for Windows, and

perhaps Mac, but ignore all other operating systems. With the rise of Linux and

other alternative operating systems, there is potential for Web Solutions to

surpass its competitors.

Key competitors are detailed as follows:

Jump.Net

Jump.Net offers a wide variety of services to match customer

needs. They have split information into two categories:

- Basic service: for customers looking for a simple,

inexpensive way to connect their home or business to the Internet.

- Complete details: for customers who need a custom solution

for unique requirements, Jump.net offers the following services:

Connectivity:

- ADSL & SDSL.

- Modem service.

- ISDN.

- Nationwide access.

Special Services:

- Colocation.

- FTP services.

- Hardware sales.

- Leased lines.

- Telnet-only service.

- Web hosting.

Arizona.Net

Arizona.Net is San Antonio's first and largest ISP. Locally

owned and operated since 1994, Arizona.Net specializes in modem dial-up, ISDN,

dedicated local area network (LAN) access and T1 (a high-speed network link that

transmits data at 1.5 Mbps) to the Internet. Arizona.Net now serves Phoenix, San

Antonio, Houston, Dallas, Spring, Georgetown, Dripping Springs, Bandera, New

Braunfels, and Boerne.

For dialup connections, Arizona.Net uses an all-digital modem

pool consisting of equipment from US Robotics, Ascend, and Livingston. All of

their locations maintain a full 56k modem pool, upgraded to the latest version

of the v.90 standard. These digital modems allow for a more reliable connection,

and enable them to make ISDN connections on the same equipment, so they can

offer 64k ISDN service with all dialup accounts. To make sure that customers can

get to their services, Arizona.Net maintains a no-busy-signal policy.

If customers report a busy signal, Arizona.Net has the ability

to connect as many telephone lines as necessary to relieve the problem.

Currently, none of their locations are having any problems with busy signals.

Arizona.Net maintains multiple separate T3 (a high-speed network link that

transmits data at 45 Mpbs) connections to the Internet backbone through multiple

backbone providers. These separate connections give Arizona.Net more than enough

bandwidth to handle future growth as well as provide the security of

uninterrupted service.

EarthLink

EarthLink helps its members have an enjoyable and productive

Internet experience by providing reliable, unlimited Internet access and Web

hosting services, outstanding technical support, useful information, and

innovative services. Prices are among the lowest in the industry. EarthLink

offers the following services:

- Internet access.

- High-speed access.

- Web hosting.

- EarthLink Sprint bundle.

Mindspring

MindSpring Biz delivers complete Business Internet Solutions

for any small business backed with its award winning service and support. Its

business plans--whether Web Hosting, e-commerce, high speed dedicated access, or

Web Design--are packaged to fit customer needs today and are tailored to grow

along with business for tomorrow. Mindspring offers the following business

solutions:

- Web hosting.

- Business access.

- E-commerce.

- Domain reservation.

- Dedicated access.

- MindSpring dialup access.

- SDSL Waiting Lis.

- Promotional solutions.

- Help desk.

The company recognizes that it is subject to both market and

industry risks. The company's view of its risks, as well as how each is being

addressed, is as follows:

- Regulations. Possible problems caused by a sudden

increase in regulation by local, State, or Federal authorities. One way the

company can reduce this risk is to diversify into several different, but

related, business areas. If one area becomes too heavily regulated it may be

sold and the profit rolled back into the company to bolster the remaining

business or start a new venture.

- Monopolistic pricing. Aggressive or monopolistic

pricing by large or heavily-funded providers. By holding prices down, it

becomes difficult for competitors to "low-ball" the company. By

diversifying, we can protect business in one area by bundling it with

offerings from another area, meeting the needs of the customers and

strengthening their ties to the company.

- Legal matters. Lawsuits stemming from user abuse or

accessibility of pornographic or questionable materials. The courts have

historically classified ISP's as "carriers" unless the ISP made an

incomplete effort to actively filter material posted by or made available to

its users. The company's usage policy clearly states that illegal behavior

will result in termination of service, but we do not otherwise attempt to

control the access of its users or their content, thus maintaining the

company's stance as a "carrier" in the eyes of the law. If the

legal environment should change, the company will modify its policies and

procedures to conform to the prevailing legal environment.

- Technology. Sudden and unexpected shifts in

technology or the popularity of the Internet. The company will maintain an

active research and development effort, as well as ongoing review of

forthcoming technologies from competitors and vendors, in order to stay near

the top of the technological curve. Also, the diversification of the

company's business allows it to respond to shifts in revenue by

redistributing material and personnel into those efforts most likely to

generate the highest return on investment.

The Web Solutions strategy is to achieve name recognition and

attract customers by aggressively pricing its services. Once customers have been

acquired, the company will seek to offer them additional services which will

increase margins and provide them with useful solutions they would not otherwise

find.

The company will also implement a low-cost strategy. This will

be achieved by working to establish and develop agreements with local media

companies to exchange services for discounted advertising and other exposures.

Web Solutions' market strategy is to build on its core portfolio of products and

services using the company's expertise in the ISP industry.

The company will leverage its discounted services to help

provide secondary income streams. For instance, the company plans to launch free

email services, business directories, and other similar services which will

attract current and potential customers to our Web pages. These "page

views" will be used to generate advertising revenue, as well as increase

exposure of our own products and services.

Web Solutions will be able to excel in the market because the

company is small, highly focused, and motivated. The company can respond quickly

to changing opportunities and take advantage of the latest technologies.

The company plans to expand its marketing efforts, service

offerings, and production. It is anticipated that additional services will be

offered and more personnel hired within 30 days of initial capital funding. Web

Solutions plans to capitalize on the following areas of growth:

- High-speed Internet connectivity via DSL, Wireless, and

other technologies.

- Web hosting and design tailored to small, local businesses.

- E-commerce and associated online databases.

Web Solutions is currently the lowest-priced provider in

Phoenix for most commercial services, and its reputation has been consistently

high. Size gives the company a competitive advantage, in that it can see where

the industry is going and move in that direction more quickly than the

competition. This also allows the company to be more efficent at recruiting and

hiring highly creative and talented individuals who tend to shy away from large

"corporate" environments. The company has worked to overcome old

mistakes made by existing ISPs by hiring technically-savvy individuals.

The concentrated marketing activities of Web Solutions focus

on the business mission and are comprehensive in nature. The following

activities are the marketing department's mission:

- Advertising design and placement.

- Public relations schedules and press releases throughout

each year.

- Creation of annual advertorial (advertisement/tutorial)

themes for trade journals and industry conferences.

- Planning and execution of all industry conferences,

including the reservation of space, booths, personnel, messages, literature,

etc.

- Collection, analysis, and internal dissemination of

competitive information.

- Creation and maintenance of all corporate literature.

- Design, maintenance, and monitoring of websites.

- Design and creation of sales support material.

- Collection and dissemination of client testimonials.

To generate sales, the company uses direct marketing, computer

reseller and repair facilities, and high-traffic areas (e.g. store checkout

stands). Currently, several local companies display the company's CD-ROMs at

their checkout stands in the Phoenix area in exchange for free Web hosting.

Marketing initiatives will focus on four areas: Colocation

("Server Hotel") facilities, Web hosting, dialup access, and content

provision. Marketing activities will be concentrated in the following

categories:

- Contact Campaigns. This initiative will encompass

various methods of reaching potential customers to generate interest,

followed by direct mail to the potential customer.

- Print Advertising. Ads will be developed and placed

in several industry publications.

- Trade Shows. The company will participate in

selected local and national shows that will provide an opportunity to

develop exposure. This is a very effective tool in creating awareness and

stimulating lead activity.

- Industry Organizations and Associates. The

recommendation is to join a number of organizations that are relevant to the

company as a whole. This initiative will create awareness of the company

within the industry, and provide networking opportunities.

- Telemarketing Campaign. Telemarketing activities

geared to identify qualified leads, follow-up on sales progress to the

qualified leads, and assurance that new potential contact lists are current

and accurate.

- Promotional GiveAways. This is a traditional way of

advertising a company's name by giving something away. This will be used in

conjunction with community service organization fund-raising efforts and

traditional advertising.

Web Solutions currently has strategic relationships with:

- World Communications for Internet service.

- Phoenix DSL Networks for DSL resale.

- Phoenix Communications for high-speed wireless.

- Internet of Phoenix for dialup connectivity (they

provide wholesale pricing in the Phoenix area).

Web Solutions benefits from these relationships by receiving

very competitive pricing on most of these services, allowing the company to

offer competitive pricing on its services to customers.

The company is currently pursuing an agreement with a local

radio station to provide Web-hosting services which will eventually include

extended email services and dial-up access offered to their listeners under a

co-branding agreement. There have also been discussions about this becoming a

nationwide collaboration between Web Solutions and the stations' parent company,

Jordan's Media.

The company plans to develop community calendaring and

groupware applications for use by the company and the afore-mentioned radio

station. This will provide a simple, useful tool for organizations, businesses,

and individuals to organize, plan, announce, and track projects and events. This

is being based on the Open Source project maintained at www.opendesk.com and

will most likely be developed to contain both Open Source and proprietary

components.

In the future, the company plans to partner with backbone

providers, wholesale carriers, and other strategic organizations to:

- Reduce cost of goods and services utilized.

- Increase the number and variety of goods and services

offered to customers.

- Chart the growth of the company into new territories.

At this time, the company is establishing re-seller agreements

with DSL and Wireless high-bandwidth providers, and other services which will

allow the company to compete in these markets, thus allowing for broader

consumer recognition.

The company's management philosophy is based on responsibility

and mutual respect. Web Solutions has an environment and structure that

encourages productivity and respect for customers and fellow employees. The

company's goal is to create an environment where:

- Creativity can flourish.

- Generating new ideas and products is well rewarded.

- Management structure is relatively flat and communication

is encouraged.

- Mutual respect and sharing of knowledge is encouraged.

| Personnel

Plan |

| |

2000 |

2001 |

2002 |

| Donald

Williams |

$30,000 |

$30,000 |

$40,000 |

| Amy

Williams |

$30,000 |

$30,000 |

$40,000 |

| Geena

James |

$36,000 |

$45,000 |

$45,000 |

| Dialup

Services Manager |

$45,000 |

$55,000 |

$65,000 |

| R

& D Manager |

$60,000 |

$60,000 |

$70,000 |

| R

& D Researcher |

$60,000 |

$60,000 |

$70,000 |

| Technical

Support Personnel |

$31,200 |

$31,200 |

$31,200 |

| Technical

Support Personnel |

$15,600 |

$31,200 |

$31,200 |

| Total

People |

8 |

8 |

8 |

| Total

Payroll |

$307,800 |

$342,400 |

$392,400 |

Web Solution's management is highly experienced and qualified.

Key members of its management teams are listed below.

- Donald Williams - President

- Amy Williams - Secretary

- Geena James - Treasurer

This section presents our financial projections for the term

of the plan.

The sales forecast chart and table are presented below. Final

sales forecasts are based on predictions mentioned in the Executive Summary.

Sales

Monthly

Click to Enlarge

The company is raising $1.5 million for the purpose of growth

and operations. This funding will cover operating expenses and product

development during this period. The following is a breakdown of how the funds

will be used.

|

Expenses:

|

Costs: |

| Advertising |

$50,000 |

|

Legal Fees

|

$10,000 |

| Office |

$40,000 |

| Working Capital |

$100,000 |

| Miscellaneous |

$50,000 |

| Sub-total |

$250,000 |

| Product Development: |

$1,250,000 |

| Total |

$1,500,000 |

Significant Assumptions

- Nature and Limitation of Projections. This financial

projection is based on sales volume at the levels described in the revenue

section and presents, to the best of management's knowledge and belief, the

company's expected assets, liabilities, capital, revenues, and expenses. The

projections reflect management's judgement of the expected conditions and

its expected course of action, given the hypothetical assumptions.

- Revenues. The company's revenue is derived primarily

from subscriptions. Revenue projections are based on the 1999 sales in the

comparable market nationwide, based on industry average. The exact numbers

can be found in the Sales Forecast table and chart section.

- Expenses. The company's expenses are primarily those

of salaries, sales commissions, and administrative costs. Other expenses are

based on management's estimates and industry averages.

The table below outlines the general assumptions of Web

Solutions.

| General

Assumptions |

| |

2000 |

2001 |

2002 |

| Plan

Month |

1 |

2 |

3 |

| Current

Interest Rate |

10.00% |

10.00% |

10.00% |

| Long-term

Interest Rate |

10.00% |

10.00% |

10.00% |

| Tax

Rate |

25.42% |

25.00% |

25.42% |

| Sales

on Credit % |

15.00% |

15.00% |

15.00% |

| Other |

0 |

0 |

0 |

The following table and chart reflect the company's break-even

estimates. These are based on fixed and variable cost estimates derived from

past income statement data. Given that Web Solutions has little in the way of

marginal costs, the break even analysis reflects the industry's high gross

margins. Unless one of the potential future risks seriously impacts

profitability, or the company loses its ability to rapidly adjust to changing

market conditions, the company does not see this as a serious issue.

| Break-even

Analysis: |

| Monthly

Units Break-even |

41,368 |

| Monthly

Revenue Break-even |

$41,368 |

| |

|

| Assumptions: |

|

| Average

Per-Unit Revenue |

$1.00 |

| Average

Per-Unit Variable Cost |

$0.05 |

| Estimated

Monthly Fixed Cost |

$39,228 |

Web Solutions is in the early stage of development, thus

initial projections have only been made on accounts that are believed to most

drive the income statement. The following table provides Web Solution's

projected income statements for 2000-2002.

| Pro

Forma Profit and Loss |

| |

2000 |

2001 |

2002 |

| Sales |

$1,500,000 |

$4,500,000 |

$7,500,000 |

| Direct

Cost of Sales |

$77,596 |

$84,296 |

$88,796 |

| Other |

$0 |

$0 |

$0 |

| |

------------ |

------------ |

------------ |

| Total

Cost of Sales |

$77,596 |

$84,296 |

$88,796 |

| Gross

Margin |

$1,422,404 |

$4,415,704 |

$7,411,204 |

| Gross

Margin % |

94.83% |

98.13% |

98.82% |

| Expenses: |

|

|

|

| Payroll |

$307,800 |

$342,400 |

$392,400 |

| Sales

and Marketing and Other Expenses |

$41,468 |

$41,468 |

$41,468 |

| Depreciation |

$0 |

$0 |

$0 |

| Legal

Fees |

$300 |

$300 |

$300 |

| Utilities |

$3,600 |

$3,600 |

$3,600 |

| Insurance |

$4,200 |

$4,200 |

$4,200 |

| Mortgage |

$67,200 |

$67,200 |

$67,200 |

| Payroll

Taxes |

$46,170 |

$51,360 |

$58,860 |

| Other |

$0 |

$0 |

$0 |

| |

------------ |

------------ |

------------ |

| Total

Operating Expenses |

$470,738 |

$510,528 |

$568,028 |

| Profit

Before Interest and Taxes |

$951,666 |

$3,905,176 |

$6,843,176 |

| Interest

Expense |

$65,506 |

$51,131 |

$36,131 |

| Taxes

Incurred |

$225,583 |

$963,511 |

$1,730,124 |

| Net

Profit |

$660,577 |

$2,890,534 |

$5,076,921 |

| Net

Profit/Sales |

44.04% |

64.23% |

67.69% |

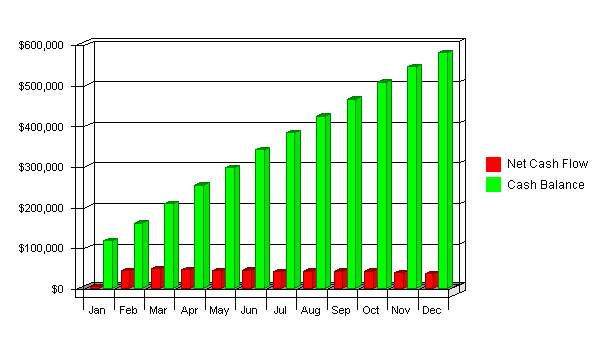

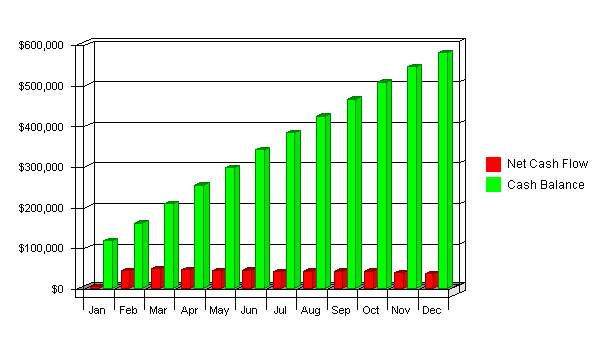

This chart and table show our cash flow and cash balance

projections.

Cash

Click to Enlarge

| Pro

Forma Cash Flow |

| |

2000 |

2001 |

2002 |

| |

|

|

|

| Cash

Received |

|

|

|

| Cash

from Operations: |

|

|

|

| Cash

Sales |

$1,275,000 |

$3,825,000 |

$6,375,000 |

| Cash

from Receivables |

$220,905 |

$619,810 |

$1,069,810 |

| Subtotal

Cash from Operations |

$1,495,905 |

$4,444,810 |

$7,444,810 |

| |

|

|

|

| Additional

Cash Received |

|

|

|

| Sales

Tax, VAT, HST/GST Received |

$0 |

$0 |

$0 |

| New

Current Borrowing |

$0 |

$0 |

$0 |

| New

Other Liabilities (interest-free) |

$0 |

$0 |

$0 |

| New

Long-term Liabilities |

$0 |

$0 |

$0 |

| Sales

of Other Current Assets |

$0 |

$0 |

$0 |

| Sales

of Long-term Assets |

$0 |

$0 |

$0 |

| New

Investment Received |

$0 |

$0 |

$0 |

| Subtotal

Cash Received |

$1,495,905 |

$4,444,810 |

$7,444,810 |

| |

|

|

|

| Expenditures |

2000 |

2001 |

2002 |

| Expenditures

from Operations: |

|

|

|

| Cash

Spending |

$48,141 |

$121,571 |

$194,346 |

| Payment

of Accounts Payable |

$829,560 |

$1,438,462 |

$2,179,741 |

| Subtotal

Spent on Operations |

$877,701 |

$1,560,033 |

$2,374,086 |

| |

|

|

|

| Additional

Cash Spent |

|

|

|

| Sales

Tax, VAT, HST/GST Paid Out |

$0 |

$0 |

$0 |

| Principal

Repayment of Current Borrowing |

$0 |

$0 |

$0 |

| Other

Liabilities Principal Repayment |

$0 |

$0 |

$0 |

| Long-term

Liabilities Principal Repayment |

$150,000 |

$150,000 |

$150,000 |

| Purchase

Other Current Assets |

$0 |

$0 |

$0 |

| Purchase

Long-term Assets |

$0 |

$0 |

$0 |

| Dividends |

$0 |

$0 |

$0 |

| Subtotal

Cash Spent |

$1,027,701 |

$1,710,033 |

$2,524,086 |

| |

|

|

|

| Net

Cash Flow |

$468,204 |

$2,734,777 |

$4,920,724 |

| Cash

Balance |

$580,816 |

$3,315,593 |

$8,236,316 |

The following table outlines Web Solution's projected balance

sheets for fiscal years 2000-2002.

| Pro

Forma Balance Sheet |

| |

|

|

|

| Assets |

|

|

|

| Current

Assets |

2000 |

2001 |

2002 |

| Cash |

$580,816 |

$3,315,593 |

$8,236,316 |

| Accounts

Receivable |

$27,595 |

$82,785 |

$137,975 |

| Other

Current Assets |

$34,650 |

$34,650 |

$34,650 |

| Total

Current Assets |

$643,061 |

$3,433,028 |

$8,408,941 |

| Long-term

Assets |

|

|

|

| Long-term

Assets |

$331,650 |

$331,650 |

$331,650 |

| Accumulated

Depreciation |

$0 |

$0 |

$0 |

| Total

Long-term Assets |

$331,650 |

$331,650 |

$331,650 |

| Total

Assets |

$974,711 |

$3,764,678 |

$8,740,591 |

| |

|

|

|

| Liabilities

and Capital |

|

|

|

| Current

Liabilities |

2000 |

2001 |

2002 |

| Accounts

Payable |

$32,409 |

$81,842 |

$130,835 |

| Current

Borrowing |

$90,338 |

$90,338 |

$90,338 |

| Other

Current Liabilities |

$90,338 |

$90,338 |

$90,338 |

| Subtotal

Current Liabilities |

$213,084 |

$262,517 |

$311,510 |

| |

|

|

|

| Long-term

Liabilities |

$495,975 |

$345,975 |

$195,975 |

| Total

Liabilities |

$709,059 |

$608,492 |

$507,485 |

| |

|

|

|

| Paid-in

Capital |

$0 |

$0 |

$0 |

| Retained

Earnings |

($394,925) |

$265,652 |

$3,156,186 |

| Earnings |

$660,577 |

$2,890,534 |

$5,076,921 |

| Total

Capital |

$265,652 |

$3,156,186 |

$8,233,107 |

| Total

Liabilities and Capital |

$974,711 |

$3,764,678 |

$8,740,591 |

| Net

Worth |

$265,652 |

$3,156,186 |

$8,233,107 |

Standard business ratios are shown in this table. Industy

Profile ratios are based on Standard Industrial Classification (SIC) Index code

7375.

| Ratio

Analysis |

| |

2000 |

2001 |

2002 |

Industry

Profile |

| Sales

Growth |

21.21% |

200.00% |

66.67% |

9.70% |

| |

|

|

|

|

| Percent

of Total Assets |

|

|

|

|

| Accounts

Receivable |

2.83% |

2.20% |

1.58% |

25.00% |

| Inventory |

0.00% |

0.00% |

0.00% |

5.30% |

| Other

Current Assets |

3.55% |

0.92% |

0.40% |

46.30% |

| Total

Current Assets |

65.97% |

91.19% |

96.21% |

76.60% |

| Long-term

Assets |

34.03% |

8.81% |

3.79% |

23.40% |

| Total

Assets |

100.00% |

100.00% |

100.00% |

100.00% |

| |

|

|

|

|

| Current

Liabilities |

21.86% |

6.97% |

3.56% |

49.40% |

| Long-term

Liabilities |

50.88% |

9.19% |

2.24% |

21.20% |

| Total

Liabilities |

72.75% |

16.16% |

5.81% |

70.60% |

| Net

Worth |

27.25% |

83.84% |

94.19% |

29.40% |

| |

|

|

|

|

| Percent

of Sales |

|

|

|

|

| Sales |

100.00% |

100.00% |

100.00% |

100.00% |

| Gross

Margin |

94.83% |

98.13% |

98.82% |

0.00% |

| Selling,

General & Administrative Expenses |

50.52% |

33.89% |

30.75% |

78.10% |

| Advertising

Expenses |

1.67% |

0.56% |

0.33% |

0.90% |

| Profit

Before Interest and Taxes |

63.44% |

86.78% |

91.24% |

1.90% |

| |

|

|

|

|

| Main

Ratios |

|

|

|

|

| Current |

3.02 |

13.08 |

26.99 |

1.57 |

| Quick |

3.02 |

13.08 |

26.99 |

1.19 |

| Total

Debt to Total Assets |

72.75% |

16.16% |

5.81% |

70.60% |

| Pre-tax

Return on Net Worth |

333.58% |

122.11% |

82.68% |

4.10% |

| Pre-tax

Return on Assets |

90.92% |

102.37% |

77.88% |

13.80% |

| |

|

|

|

|

| Additional

Ratios |

2000 |

2001 |

2002 |

|

| Net

Profit Margin |

44.04% |

64.23% |

67.69% |

n.a |

| Return

on Equity |

248.66% |

91.58% |

61.66% |

n.a |

| |

|

|

|

|

| Activity

Ratios |

|

|

|

|

| Accounts

Receivable Turnover |

8.15 |

8.15 |

8.15 |

n.a |

| Collection

Days |

48 |

30 |

36 |

n.a |

| Inventory

Turnover |

0.00 |

0.00 |

0.00 |

n.a |

| Accounts

Payable Turnover |

24.42 |

18.18 |

17.03 |

n.a |

| Payment

Days |

17 |

14 |

17 |

n.a |

| Total

Asset Turnover |

1.54 |

1.20 |

0.86 |

n.a |

| |

|

|

|

|

| Debt

Ratios |

|

|

|

|

| Debt

to Net Worth |

2.67 |

0.19 |

0.06 |

n.a |

| Current

Liab. to Liab. |

0.30 |

0.43 |

0.61 |

n.a |

| |

|

|

|

|

| Liquidity

Ratios |

|

|

|

|

| Net

Working Capital |

$429,977 |

$3,170,511 |

$8,097,432 |

n.a |

| Interest

Coverage |

14.53 |

76.38 |

189.40 |

n.a |

| |

|

|

|

|

| Additional

Ratios |

|

|

|

|

| Assets

to Sales |

0.65 |

0.84 |

1.17 |

n.a |

| Current

Debt/Total Assets |

22% |

7% |

4% |

n.a |

| Acid

Test |

2.89 |

12.76 |

26.55 |

n.a |

| Sales/Net

Worth |

5.65 |

1.43 |

0.91 |

n.a |

| Dividend

Payout |

0.00 |

0.00 |

0.00 |

n.a |