| Market Structures |

|

| Summary |

How marketing of products are affected. This changes due to the behavior of the producers. |

| Types of Market Structures: |

1] Monopoly

2] Oligopoly

3] Perfect Competition

4] Monopolistic Competition |

| Monopoly |

| Characteristic |

Definition |

| Only one supplier |

There is exactly one source of a product. That source monopolizes the product. All who buy that

product must get from that company. |

| Prices tend to increase |

Since there is only one source of a product/service, nobody has any alternative even if prices

increase since no other company sells it. |

| Examples |

the Meralco™ company monopolizes power distribution |

|

| Oligopoly |

| Characteristic |

Definition |

| Several producers |

There is more than one choice for a product. There are multiple sources but these sources aren't

that many. Siguro mga 3-4 maximum. |

| Prices tend to increase |

When one increases his price, the others increase their prices too. When innovation becomes

available, others also apply this innovation. |

| Examples |

Smart™ and Globe™ are in Oliogopoly with each other |

|

| Perfect Competition |

| Characteristic |

Definition |

| Several sellers |

In this system, there are so many sellers of the same product. They didn't make the product,

they just sell it. |

| Prices are kept reasonable |

Di sila pde magtaas ng price or else lugi sila. But, they sometimes resort to other ways to

maximize their profit. |

| Examples |

ang daming ballpens parepareho lang ginagawa. |

|

| Monopolistic Competition |

| Characteristic |

Definition |

| Several alternatives |

There is no exact substitute for the product/service. But there are alternatives that are not

the same pero pag ginamit mo, di mo na rin pde gamitin ung isa. |

| Prices independent of each other |

Syempre pag iba yung product you can't base your price on the other product. But they also tend

to increase, lagi naman nagmamahal eh. |

| Examples |

instead of taking the bus, pwede mag MRT. instead of spoon and fork, pdeng spork! pareho yung

effect pero ibang-iba yung product/service |

|

| Supply and Demand |

|

| Law Of Supply |

| Supply |

The variations of a product sold at varied prices. |

| Relationship w/ prices |

Directly proportional. When prices are low, producers are less willing to make the products.

High prices = producers more willing to make and sell. |

| Relationship w/ quant. |

As quantity increases, supply price also increases. Slope of the line is / |

| Relationship w/ demand |

The intersection of S&D in the graph will tell Pe and Qe |

|

| Law Of Demand |

| Demand |

The ability and/or willingness of the market to consume a product. |

| Relationship w/ prices |

Inversely Proportional. When prices go down, demand for the product goes up. High prices = the

consumers are less willing and/or able to buy. |

| Relationship w/ quant. |

As quantity increases, demand price decreases. Slope of the line is \ |

| Relationship w/ supply |

The intersection of S&D in the graph will tell Pe and Qe |

|

| >Other terms |

| Price Equilibrium (Pe) |

Market price; the price producers are willing to sell and the consumers are willing to pay; the

intersection point of the supply and demand curves w/ reference to price. |

| Quantity Equilibrium (Qe) |

The quantity producers are willing to sell and consumers are willing to buy; the intersection

point of the supply and demand curves w/ reference to quantity. |

| Surplus Units |

Quantity that remains unconsumed; occurs when demand is less than supply or price is set higher

than the equilibrium. |

| Shortage Units |

Quantity that is still being demanded; occurs when demand is greater than supply or price is

set lower than the equilibrium. |

|

| Things to remember |

Ang price equilibrium sa graph ay nasa gitna ng two numbers always. Use the two prices kung saan

nakapagitna ang intersection of supply and demand. Kung sakto sa line, use that price and the next

higher price.

In the price equilibrium, theoretically, there are no surplus nor shortage units.

Sundin ang instruction! pag sinabing graph using a certain interval (ie. 4) edi use intervals of 4

para makuha mo ang same graph na ginusto ni sir. Although, di naman yata kelangan malaman ito dahil

inaasahan kong totoo ang sinabi ni sir na all multiple choice. |

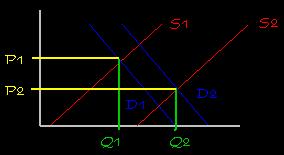

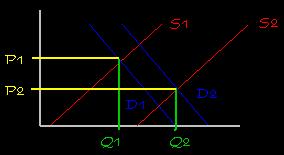

| Graphing Supply and Demand |

|

| Things to remember |

>Quantity is an independent variable. It will always increase as you go to the right.

>Price is the dependent variable. Graphing supply, tumataas ang curve pag tumataas ang quantity.

>On the other hand, graphing demand, bumababa ang curve pag tumataas ang quantity.

>In short, higher supply for higher quantity and higher demand for lower quantity

>Movement to the right (S1 or D1 is to d left of S2 or D2

) means an increase. Supply/Demand increased.

>And vice versa, movement to the left means a decrease.

>Wider gap between 1 and 2 = the movement (inc/dec) is greater. Smaller gap =

the movement is less

>Pag dindrawing ang intersections, remember na ang intersection 1 ay ang intersection ng lahat ng "1"

lines. Wag malito baka mmya intersection ng S1 and D2 ung nadraw nyo. Or D1 at P2, etc. |

Examples

for uniformity, i will use:

red = supply,

blue = demand,

yellow = price,

green = quantity,

|

| ^S > ^D = ?? [find P and Q] |

|

(sori kung mukhang grafiti/vandalism panget di ko na ib-black un background ng pictures)

makikita na ang supply ay nagshift to the right (S2 is to the right). demand din ay nagshift to d

right. obserbahan ang gaps bet. lines. ang supply lines may mas malaking gap kesa demand. tapos

draw d corresponding price and quantity lines.final equation:

[ ^S > ^D = vP^Q ] |

|

| Price Elasticity |

Price elasticity ay defined as the responsiveness or reaction of consumers to price change.

Price elasticity of a product can possibly defy the law of demand, with regards to an increase in

price. Kung babalikan ang law of demand makikita na ang increase in price will give a decrease in

demand dahil fewer people are willing/are capable of buying at the higher price. Pero there are some

products that even if they increase in price, we still continue to buy at the same rate and sometimes

even more.

elastic products - those which agree with the law of demand. Di na bibilin pag nagmahal.

inelastic products - those which defy the law of demand. Bibilin parin kahit nagmahal. |

| Factors that affect elasticity |

| Degree of Necessity |

How much we need the item. Basic needs are usually inelastic. |

| Budget Alloted |

What portion of income is alloted for it. Kunyari, gasoline may certain percentage of our money

nakatabi for that, pag tumaas ung price, mas konting gas na ung mabibili. |

| Availability of Substitutes |

Goods and services in monopoly are inelastic, since wlang pamalit dun. |

| Time Period Involved |

Parang seasons sa first term. Pag xmas time, ang mga bilihin ay tumataas ng price pero we still

buy them kac pambigay ng gifts. |

|

| Computing for price elasticity |

Mayroong 2 formulas to remember, pero i will show paano naderive ang second equation from the first

one. Makikita na pareho lang ang dalawang ito.

| Gen. formula: |

%ΔQ

%ΔP |

In elasticity, ang goal natin is to get the percentage change in quantity and divide it wid d

percentage change in price. The percentage change of a value ay nako-compute by getting d diff.

of the values and dividing it by the original value. It becomes (K2 - K1)

÷ K1 where K is the value being computed (its either d quantity or d price). |

| Plugging in this computation into the general formula gives us the 1st formula |

| 1st formula: |

Q2 - Q1

___Q

P2 - P1

P |

Makikita d2 na nagd-deal tayo with a complex fraction which has multiple denominators. Madali

lang ito, just take it step by step.. First ay subract Q1 from Q2 and then

divide by Q1. Tapos subtract P1 from P2 and divide by P1

. Tapos divide the answer from the Q part by the answer from the P part. The answer will be

the elasticity of the product. |

| You can resolve this fraction para makuha ang isang mas simple at mas maikling

formula. |

| 2nd formula: |

P ΔQ

Q ΔP |

Yan, sobrang mas madali pero it gives the exact same answer. Remember na dividing fractions is

simply multiplying the upper part with the reciprocal of the lower part. Doing this gives this

particular result:

Q2 - Q1 · P___

Q P2 - P1

And multiplying it gives the second formula. Note na ang ΔK is just a shortened version of

the computation (K2 - K1) where K is the value being computed (its either d

quantity or the price). |

| We go now to the types of elasticity of a product. |

| Types of elasticity |

Inelastic |

Even if product increases price, demand stays the same or can even increase too.

Occurs if elasticity is 0.4 and below. |

| Unitary |

It means that if product increases price, demand decreases at the same or almost the same rate.

Occurs if elasticity ranges from 0.5 to 1.4 |

| Elastic |

It means that if the product experiences increase in price, demand goes down. Follows the law

of demand. Occurs if elasticity is 1.5 and above. |

|

| Inflation and Consumer Price Index |

|

| Inflation |

Basically, inflation refers to increase in price of basket goods.

Basket goods and services are the goods and services purchased customarily by the average

family in a given place at a given time. Parang, commonly bought items. |

| Types of inflation |

- Demand pull - increase in the income of people means more spending power. Thus, people are more

willing/able to buy at higher prices. This makes it safe for producers to increase prices. It happens

ta certain times too like ngayon, xmas time. Xmas bonus means more money. This is the only positive

kind of inflation because it was caused by a positive event (more money).

- Cost push - Increase in the costs of manufacturing, transporting, packaging, etc. of a product

causes prices to rise in order for producers to gain the same amount of profit. The prices are all

pulled up by manufacturing costs and cost of raw materials.

- Oil push - not really a separate kind of inflation, it's a special case of cost push. Dahil ang

oil ay basic resource, an increase in oil price means a universal increase in prices for all products

in the affected area. Oil is used for transportation, manufacturing, etc kaya apektado lahat.

|

| Consumer Price Index Table |

This is basically a table which shows how much inflation has taken place throughout several years,

using a base year for comparison. |

| Example (taken from LT2) |

| Commodity |

Unit |

Q |

P0 |

P1 |

P2 |

| Notebooks |

Pc |

12 |

12.50 |

14.75 |

15.50 |

| Shirts |

Pc |

5 |

89.95 |

99.95 |

99.95 |

| Shoes |

Pair |

2 |

1500 |

1700 |

1800 |

| Pens |

Pc |

5 |

5 |

5 |

5 |

| Bags |

Pc |

1 |

1200 |

1200 |

1500 |

| Rulers |

Pc |

3 |

4.50 |

5 |

4.50 |

|

| Analyzing the Consumer Price Index Table |

Weighted price P(item) - the weighted price for an item, given by the price of that item for

that year multiplied by the quantity.

Total Weighted Price (TWP) - is the total price of all commodities for that year, makukuha ito

by adding all the weighted prices of all the items for that year

Consumer Price Index (CPI) - percentage of the TWP of a year compared to the base year. Get it

by dividing the TWP of a year by the TWP of base year and mult. by 100.

Price Level Change (PLC) - by how much nag-increase ang CPI of a year as compared to the base

year. Just subtract 100 from the CPIn.

It helps if u place the P(item) for that year in the remaining space to the right of it's price.

Para hindi mo makalimutan and won't have to do everything in one go. Baka magkamali pa pag pindot sa

calcu. So doing this, the table above will now look like this: P(item) is in red

| Commodity |

Unit |

Q |

P0 |

P1 |

P2 |

| Notebooks |

Pc |

12 |

12.50 150 |

14.75 177 |

15.50 186 |

| Shirts |

Pc |

5 |

89.95 449.75 |

99.95 499.75 |

99.95 499.75 |

| Shoes |

Pair |

2 |

1500 3000 |

1700 3400 |

1800 3600 |

| Pens |

Pc |

5 |

5.00 25 |

5.00 25 |

5.00 25 |

| Bags |

Pc |

1 |

1200 1200 |

1200 1200 |

1500 1500 |

| Rulers |

Pc |

3 |

4.50 13.50 |

5.00 15 |

4.50 13.50 |

So just add vertically to get the TWP for the year. Tapos divide TWPn by TWP0 tas

mult. by 100 to get CPI. Then subtract 100 from CPIn to get PLCn. Ayus! |

| Taxation |

I don't really know much about this, kac hinabol lang sa amin tong topic na to. Anyway sabi naman

ni sir na madali lang to. Just stock knowledge.. |

| Why are there taxes? |

Taxes ay ipinapataw ng ating gobyerno in order for them to gain money for our country devt.

Ang taxes na binabayad ng tao ay ginagamit for infrastructure, education, public works and the like.

Sinasabing dapat magkaroon ng positive attitude towards taxes. On the contrary, ang mga pinoys still

continue to find ways to evade taxes. That's one reason na hindi tayo umaangat. On the other hand, me

katwiran din ito dahil corruption is so rampant sa ating bansa. A big portion of the taxes is set

aside to pay for the debt to the International Bank. Hanggang ngayun ay di parin natin mabaya-bayaran

ito. |

| Anu-ano ang naibigay ng taxes |

Education - education in government schools is subsidized by the taxes. Specially in UP, a

big amount of the tuition fee is paid for by taxes from the people. Kaya tinawag na "skolar ng bayan"

kac ung taong bayan ang nagbayad ng pagpapaaral sa kanila.

Social Security - SSS at GSIS ang mga social security firms that run on taxes. Pag nagretire

ang isang tao pde pa cya makakuha ng pera from his SSS or GSIS funds. Pde rin mag-loan galing dito.

This gives a degree of security for the people.

Salaries - the wages of a government employee is taken entirely from the taxes. Pag wlang nag

bayad ng tax, wla silang sweldo, pano na ung pamilya nila??

Public works - ang improvement of the Philippines ay nakasalalay sa taxes. If wlang taxes, di

magdedevelop ang healthcare, transportation, public service, etc. Government hospitals, roads (like

skyway), transportation (like mrt,lrt) and others are all products of our taxes. |

| Kinds and examples |

There are basically two classifications of taxes: direct and indirect

| Direct Taxes are taxes that you actually have to pay for. Pag direct tax, as

in makikita mo talaga na sinisingil ka for the tax. Para kang may bill for tax. |

| Income Tax |

Pag private/self-employed ka, you remit your receipts and invoices, tyka transaction records to

an accountant tapos cya ung magf-file ng tax sa BIR. This is a percentage from your income na bigay

sa govt. Pwedeng ikaw na rin ang mag file at magpuntang BIR para magbayad. Sadly, most people hire

an accountant to make their income appear low, para maliit lang ung tax na bayaran nila |

| Withholding Tax |

Pag empleyado ka ng isang company, this tax is computed by d boss, tapos pagdating sayo ng sweldo

mo, bawas na un ng tax. Tapos at d end of the month bibigyan ka ng reports about your withholding

tax. Sort of like the income tax for mga empleyado/non-private. |

| Real-Estate Tax |

Tax na ipinataw sa mga land/property that you own. You pay this every year tapos the value is

computed according to the value of your property. Certain percentage nito. |

| Indirect Taxes are taxes na pinatong na sa prices ng mga bilihin. Dito, kasama

na sa cost nung whatever you bought ung tax na yun. |

| Value Added Tax and Extended Value Added Tax |

For certain products. Basta, basic tax for goods and services. Sometimes extended pa. |

| Entertainment Tax |

Pag nanonood ng movie, kasama sa bayad ng ticket ito. |

| Sin Tax |

For vices like tobacco and alcohol. Tsk tsk tsk. Hahaha. It's a way of saying that these are not

encouraged by the government. |

| and many many more taxes.. la ng tigil... |

|