Blue chip stocks

A "blue chip" is the nickname for a high-quality stock that is

thought to be safe, in excellent financial shape and firmly entrenched as a

leader in its field. These kinds of stocks have been called "blue

chips" for decades. the phrase blue chip comes from poker where the

highest and most valuable playing chip is blue. It is an interesting reference

in that the game of poker and the stock market both involve some elements of

skill, luck and risk. Blue chips belong to companies renowned for the quality

and wide acceptance of their products and services, and for their ability to

make money and pay dividends in both good and bad years. Blue chips generally

pay dividends and are favorably regarded by investors especially by investors

with a conservative risk tolerance.

A few examples of blue chips are Wal-Mart, Coca-Cola, Gillette, Berkshire

Hathaway and Exxon-Mobile. Blue chip stocks are sometimes referred to as

bellwether issues. Despite their reputation as boring, stogy and perhaps even

a little outdated, blue chip stocks have long reigned supreme in the portfolio

of retirees, non-profit foundations and conservative individuals. These

companies often reside at the core of American business and boast pasts as

colorful as any novel. Yet the prosaic-ness attributed to them is certainly

not deserved; there is nothing more exciting than making a profit and that is

certainly what blue chips are all about. Information about blue chip stocks is

usually found on the Dow Jones Industrial Index.

EXCHANGE-TRADED FUNDS

Exchange-traded funds (ETFs)

are like index mutual funds that behave like stocks. They trade all day on

recognized stock exchanges such as the American Stock Exchange, and some trade

during extended hours. These funds are not actively managed; they are like

index funds that are passive. They replicate an index, such as the S&P 500

index or a growth stock index, without trying to outperform that index.

The trustee updates the holdings every few seconds to keep the net asset value

of the ETF in line with the market. This is a lot of updating, so you obtain

better tracking results with a smaller index like the Nasdaq-100 than you do

with a large one such as the ONEQ that tracks every Nasdaq stock. As with any

trust, there is a custodian who holds the securities that the trustee buys.

There is a lot of free education about ETFs on the Internet now that the

public has joined hedge funds in trading these instruments. Nuveen Investments

has a web site, ETFConnect, at www.etfconnect.com; and, as usual, Yahoo.com

has extensive information on this popular new trading vehicle.

Exchange-traded funds are important to us for two reasons. First, they provide

a way for our model portfolio to invest in two potentially lucrative assets:

the Nasdaq Composite index and gold bullion. There is no Nasdaq index fund and

there is no convenient way to trade gold. Exchange-traded funds are the only

way to put these two investments into a real portfolio. Second, they expand

our options for sector investing. Both functions are equally important to our

model portfolio.

Before we examine the details of ETFs, however, let us inject a little Wall

Street wit.

Nicknames for some of the first ETFs reflect this industry’s penchant for

dry humor. The first ETF appeared in 1993 with the objective of replicating

the total return of the S&P 500 index. The name of the trust is Standard

& Poor’s Depositary Receipts (SPDR). Its stock symbol is SPY, and it

quickly earned the nickname “spider.” Newspaper advertisements for this

fund, or trust, featured a spider building a web of financial security. It is

the same with the first ETF for the Dow Jones Industrial Average. The symbol

is DIA; the nickname is “diamonds,” and the advertisements include

gemstones. Vanguard, which started the indexing trend with their family of

mutual funds, created a group of ETFs called Vanguard Index Participation

Equity Receipts (VIPERs). The Nasdaq-100 ETF has the symbol QQQQ and the

nickname “cubes.” Wall Street loves nicknames.

EQUITY ETFS

Standard & Poor’s

Depositary Receipts offer a convenient way to implement the trading decisions

generated by our model portfolio. Each SPDR owns all 500 of the stocks in the

S&P 500 index in their market capitalization weight. We can trade the SPDR

all day and into extended hours; we can buy and sell options on it; and we can

leverage it in the futures market. There is a price for all this flexibility;

your broker will still charge a commission when you buy any ETF. If you are

charged about $30 and you are investing less than $30,000, you are better off

in an index fund directly from Vanguard. Larger investments, obviously,

benefit from economies of scale in trading commissions.

Vanguard does not, however, offer a mutual fund that replicates the 3,000

stocks in the Nasdaq Composite index. This index is one of the investments

that gave us outstanding returns in our model portfolio, but until 2003 there

was no way to buy that index. The only way to capture all of the Nasdaq stocks

in one trade is to buy the Fidelity Nasdaq index fund called the ONEQ. Its

management fee of about one-half of 1 percent causes it to underperform its

benchmark a little, but we finally have a way to invest in the Nasdaq

Composite index.

Other equity ETFs track a myriad of sector indexes that help us with our

sector rotation investing and our selection of individual stocks.

Index ETFs are true index funds as opposed to the sector mutual funds. Those

sector funds may hold only 80 percent of their assets in their sector, but

ETF’s have as much money as possible invested as a mirror image of their

index. Because exchange-traded funds are truly passive, many of them have

lower fees and better tracking results than traditional sector mutual funds.

The new exchange-traded funds offer hundreds of ways to track indexes in all

of our asset classes. They also include the four styles: large and small

capitalization and value or growth stocks. Then, of course, there are ETFs

offering indexes of blended styles.

FIXED-INCOME ETFS

Fixed-income ETFs fall into two

categories: international and domestic. Barclays Bank is the trustee for a

family of foreign fixed-income ETFs that allows investors to choose among

several points along the yield curve. Like a traditional bond mutual fund, an

ETF will never mature; so investors are just choosing whether they want

short-, intermediate-, or long-term investments. In effect, they are buying

perpetual bonds of a particular duration. Goldman Sachs acts as trustee for an

ETF that mirrors its corporate bond index, and Lehman Brothers is the trustee

for several U.S. government security funds. These funds may be one of an

investor’s better opportunities to get institutional prices for bonds.

REAL ESTATE ETFS

The fund selector on Yahoo.com identified four real estate investment trust

ETFs. Each one tracks an index for different parts of the domestic REIT

market. The oldest one is the iShares Dow Jones U.S. Real Estate ETF that came

out in 2000 when the yield curve inverted. The fund went from $55 per share at

inception to $123 per share four and a half years later and earned an average

annual return of 20 percent. As you know, the stock market lost 20 percent

during those four years. Whoever made that new product decision at Dow Jones

probably uses the same yield curve analysis that you and I do.

GOLD BULLION ETFS

Gold ETFs are one of the few

ways that people can invest in gold bullion near a price that is usually

available only on an exchange. These ETFs buy gold bullion and store it in a

vault. This is very different from gold mutual funds that own shares in mining

companies but do not own the gold itself.

The two investments behave quite differently during a crisis. Mining companies

trade like any other stock when investors panic and sell equities

indiscriminately. At a time like this, gold stocks decline along with all the

others. The physical commodity of gold, however, often provides a safe haven

during uncertain times and makes money when stocks crash.

The first gold bullion ETF appeared in November 2004 and attracted a

phenomenal $1.3 billion in assets during the first two months. This gold ETF,

StreetTracks Gold Shares, uses the symbol GLD. Unlike most ETFs, it trades on

the New York rather than the American Stock Exchange.

Yahoo.com shows two performance numbers for each ETF: that of the ETF itself

and that of the index it replicates. Investors can see how well their fund is

doing its job of tracking its benchmark, and StreetTracks Gold Shares appears

to lag the performance of gold by about one-half of 1 percent. This

discrepancy is probably due to the cost of storing the gold. Owning an ETF may

be the cheapest way to buy and store gold because economies of scale allow the

trust to buy gold near the price on a major exchange, such as the COMEX in New

York, and spread the storage costs among so many investors.

Now that we have investment vehicles that represent gold on the COMEX and the

Nasdaq Composite index, we can use them in our model portfolio instead of cash

and the S&P 500 index. For the sake of simplicity, however, we will use

our usual trade dates rather than buying gold when the 10-year, three-month

yield spread exceeds 10 percent. We will start after 1973 when the price of

gold was allowed to fluctuate (see Table 1).

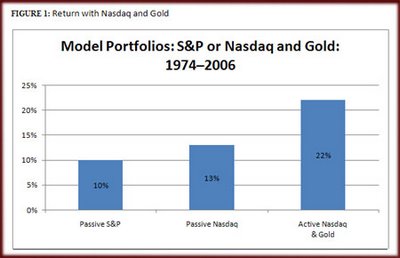

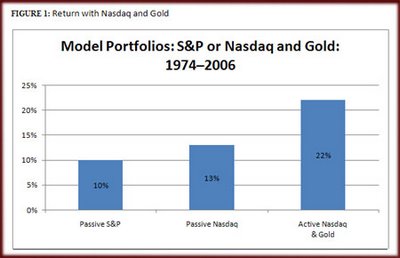

All of our returns look better with our new starting date; even the S&P

500 index improves a couple of percentage points compared to previous graphs.

The more aggressive equity investment, the Nasdaq index, provides one-third

more return even without active management; including dividends on the larger

index would have closed this gap a little. As Figure 1 shows, trading two

aggressive instruments, Nasdaq and gold, more than doubled the return of the

unmanaged S&P 500 index.

The dollar amounts of the three portfolios are vastly different because of the

impact of annual compounding at different rates (see Figure 2).

The returns might have been even stronger if we had used foreign currencies.

FOREIGN CURRENCY ETFS

Foreign currency ETFs are similar to international equity index funds except

that they may own stocks in a global index. There are many global indexes, and

the term includes the United States. If your objective is to own nothing but

foreign currencies, make sure that your ETF does not include U.S. investments.

The web site ETFConnect is one of the few that allow you to search their

databases by investment objective, and a search for global investments found

37 funds matching that description.

The difficulty with mutual funds and ETFs is that convenient products like

these usually become available a little late in the investment cycle.

Cutting-edge investors often have to do their own homework and invest directly

in stocks in order to get in at the beginning of each new cycle.

Investing directly in stocks provides the opportunity for greater returns than

investing in an index fund. Of course, the risks are greater as well, but our

market timing model should allow you to focus on the right sector. Once you

become familiar with the business and the companies in a sector, you are in a

good position to buy a strong security. Sector investing provides the

background you need as well as a list of companies from which to select your

investment.

SUMMARY

There is a wide variety of new funds that provide inexpensive diversification

with a minimum of homework. Exchange-traded funds add to our flexibility for

trading throughout the day, and some of them take advantage of extended

trading hours. Many of them have lower fees than sector mutual funds that may

impose a sales charge or marketing expense. Unlike mutual funds, however, ETFs

incur a brokerage fee as if they were a stock.

These funds are important to us because they complete the tools we need to

implement our model portfolio. Up to now we have been able to invest in all

asset classes except for gold bullion and most equities except for the Nasdaq

Composite. Two of these new funds fill those gaps. One fund, StreetTracks Gold

Shares with the symbol GLD, gives us a chance to own gold bullion near the

price it trades on the COMEX division of the New York Mercantile Exchange.

Another ETF, the ONEQ, allows us to own all 3,000 stocks in the Nasdaq.

The rest of the exchange-traded funds offer hundreds of ways to invest in

industry sectors and styles with low portfolio management fees. They open a

window on a segment of the business world and supply us with a list of

companies to study in depth. Once we have mastered an industry, we are ready

to choose one of the stocks on this list to buy.