|

|

Is it a tunnel we're careening into or a rabbit hole? |

Last Update: 11/02/01 4:20 PM EST

This week is going to end on an even-Steven close. The market took a left hook when it wasn't looking. Battered and bruised, it did a knee-jerk effect and pulled back some. Since it looks like Nasdaq can hold 1700, it looks like it will stay there as I mentioned in the last column.

This week is going to end on an even-Steven close. The market took a left hook when it wasn't looking. Battered and bruised, it did a knee-jerk effect and pulled back some. Since it looks like Nasdaq can hold 1700, it looks like it will stay there as I mentioned in the last column.

This week has had more bad news. NAPM plunged to 39.8% from 47.0% in September. The Labor Department said the national unemployment rate soared half a percentage point to 5.4 percent last month (415,000 jobs) from 4.9 percent (in September 213,000 jobs, 54,000 in August) -- the highest in nearly five years since a matching 5.4 percent rate in December 1996. It is also the sharpest decline for any month since May 1980, when 464,000 were dropped from payrolls. It is the third month in a row. Consumer confidence plummeted in October to its lowest level in more than seven years, as the terrorist attacks sapped Americans' optimism about job security and the economy. The government reported that the economy shrank 0.4 percent in the third quarter, the biggest drop since the last recession in 1991, and a signal that the country may be heading toward a full-blown downturn.

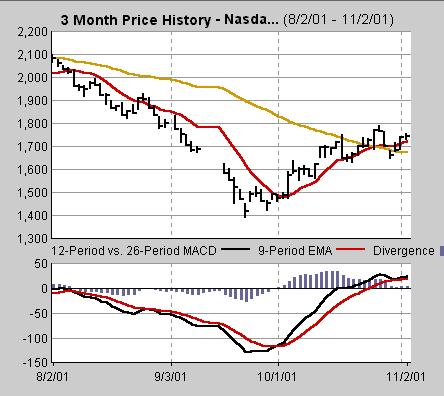

I havent seen real proof that there will be a significant upside, at least until next month or so. Let's check the chart.

As you can see from the 3 month chart, Friday's (11/02) activity lends itself to solidarity. I'm hopeful that it will grow some legs, but I cant be sure. Another significant drop next week will put a negative bias on the technicals.

Movers & Shakers

Ford Motor named a new CEO and, it was encouraging to have an IPO do well. National health benefits company, Anthem (ATH 40.90 +4.90), is a Goldman Sachs led deal. Enron is still in a downward spiral as a result of their SEC snafus and a lack of investor confidence. Their shares are down a whopping 80% YTD, like many other stocks.

Disclaimer: The remarks made herein are the expressed opinion of the individual cited above. No recommendation of the purchase or sale of stocks should be made without consulting your financial advisor or proper due diligence.