| 歡迎光臨 Ez Working Skills/BusinessPlan |

請用瀏覽器之退后(back) 鍵返回前頁 |

Business Plan for Nonprofit trade association of Motorsports

| 1.0 Executive Summary | [back to top] |

Introduction

The Connecticut Motorsports Business Association is a nonprofit

trade association of motorsports businesses in Connecticut and other interested

parties. CMBA works to enhance and improve the motorsports business climate in

Connecticut by promoting the sport to the general public, protecting the rights

of motorsports businesses, and assisting businesses to improve their sales and

profits.

The Organization

CMBA was founded in 1974 as the Connecticut Motorcycle Dealers

Association. In 1992 the association expanded to allow motorcycle accessory

shops full participation in the Association. The name was changed in 1995 to the

Connecticut Motorsports Business Association in recognition of the other

motorsports products, such as personal watercraft and ski mobiles, that our

members sell and service.

Our management team consists of the board of directors and officers of CMBA working closely with the executive director. In addition, a professional lobbyist is employed to keep us appraised of legislative activities and to help us affect desired outcomes. Ultimately the work will be divided among committees and the executive director may need to add staff to the Association management team.

Services

CMBA provides a variety of services to motorsport businesses

including the scheduling and coordination of a number of activities and events.

These include monthly dinner meetings for information sharing, a spring

motorcycle show, the winter conference and seminars, an annual Awards Banquet,

and an annual Connecticut SuperRide.

In addition we provide direct services to motorsport businesses that include professional lobbyist services to represent our members with government agencies, communications in the form of a monthly newsletter and regular monthly meetings as well as special bulletins, and group benefits such as coordinating our members' dealings with insurance companies and distributors for rates and discounts.

Among the services planned for the future are: a group insurance medical plan for all members, a group buying plan, bringing the CMBA members onto the Internet for consumer sales and inter-member product distribution, a permanent rider education facility, and the development of a Connecticut Motorsport Park.

The Market

Research shows that the motorcycle industry has been growing for

the past seven years. This includes all types of motorcycles. Today's retail

sales produce more than 3.5 times the dollars produced in 1983. In addition,

Powersports research stated that "56% of motorsports customers turn to

their friendly neighborhood dealer for all of their routine service work."

This creates a market with tremendous opportunities for small, local businesses

if they can get the right tools to take avantage of the possibilities. For the

most part, our potential members are very small businesses with limited

resources for training and marketing. We can help them improve their earnings

and increase the value of their investments with sales and management training

and well as marketing information and marketing aids.

There are more than 100 businesses in Connecticut involved with motorsports. In addition, there are potential associate members outside the state, such as manufacturers, distributors, insurance companies, and others who service and sell to our members.

Since CMBA's goal is to bring together all interested parties in the motorsport industry, the company plans to have a broad target market with management focusing on franchised dealers, independent accessory and repair outlets, insurance companies, distributors/manufacuturers, and other interested parties.

Financial Considerations

Our main strategy is the growth of membership. A large membership

base provides revenue from dues and also positions CMBA as the true

representative of the Connecticut motorsports industry.

We want to finance growth solely through cash flow. We recognize that this means we will have to grow more slowly than we might like but that no assessment of members or borrowing is necessary.

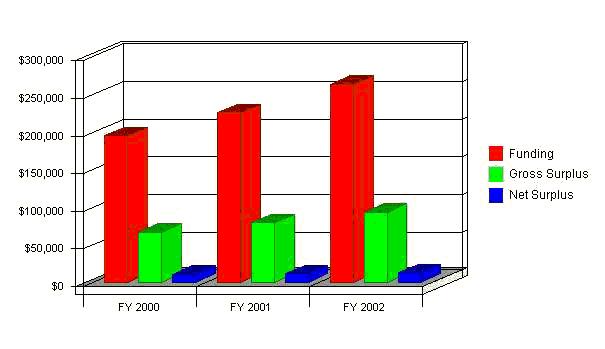

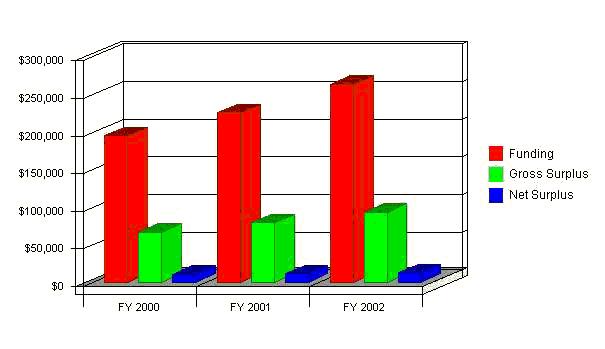

Our sales on membership and other services is expected to increase from more than $195,000 the first year to more than $263,000 the third. Net profit is estimated to rise from ~$10,000 in year 2000 to ~$12,500 in year 2002. Cash flow is expected to remain healthy. Profits are planned to be applied to legislative activities, marketing activities, or held for contingencies.

Highlights

| 1.1 Objectives | [back to top] |

| 1.2 Mission | [back to top] |

The Connecticut Motorsports Business Association is a trade association of motorsports businesses in Connecticut and other interested parties. CMBA works to enhance and improve the motorsports business climate in Connecticut. It is a recognized and respected representative and proponent of the motorsports industry.

| 1.3 Keys to Success | [back to top] |

| 2.0 Organization Summary | [back to top] |

The CMBA has been Connecticut's only trade association for motorcycle and motorsports businesses since 1974. Our focus is on improving and enhancing the motorsport business climate in Connecticut by:

| 2.1 Legal Entity | [back to top] |

The Connecticut Motorsports Business Association, Inc. is a Connecticut nonprofit corporation.

| 2.2 Organization History | [back to top] |

CMBA was founded in 1974 as the Connecticut Motorcycle Dealers Association. In 1992 the name was changed to the Connecticut Motorcycle Business Association to allow motorcycle accessory shops full participation in the Association. The name was changed again in 1995 to the Connecticut Motorsports Business Association in recognition of the other motorsports products, such as personal watercraft and ski mobiles, that our members sell and service.

| Past Performance | |||

| FY 1997 | FY 1998 | FY 1999 | |

| Funding | $18,000 | $20,000 | $20,780 |

| Gross Margin | $3,000 | $5,000 | ($631) |

| Gross Margin % | 16.67% | 25.00% | -3.04% |

| Operating Expenses | $50 | $50 | $50 |

| Collection Period (days) | 0 | 0 | 0 |

| Inventory Turnover | 0.00 | 0.00 | 0.00 |

| Balance Sheet | |||

| Current Assets | FY 1997 | FY 1998 | FY 1999 |

| Cash | $11,000 | $17,000 | $12,000 |

| Accounts Receivable | $0 | $0 | $0 |

| Inventory | $0 | $0 | $0 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $11,000 | $17,000 | $12,000 |

| Long-term Assets | |||

| Capital Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $11,000 | $17,000 | $12,000 |

| Capital and Liabilities | |||

| FY 1997 | FY 1998 | FY 1999 | |

| Accounts Payable | $0 | $0 | $0 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $0 | $0 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $0 | $0 | $0 |

| Paid-in Capital | $0 | $0 | $0 |

| Retained Earnings | $11,000 | $17,000 | $12,000 |

| Earnings | $0 | $0 | $0 |

| Total Capital | $11,000 | $17,000 | $12,000 |

| Total Capital and Liabilities | $11,000 | $17,000 | $12,000 |

| Other Inputs | FY 1997 | FY 1998 | FY 1999 |

| Payment Days | 0 | 0 | 0 |

| Funding on Credit | $0 | $0 | $0 |

| Receivables Turnover | 0.00 | 0.00 | 0.00 |

Past

Performance

| 2.3 Locations and Facilities | [back to top] |

Since its inception, the CMBA's office has been that of its president. Since the mid-1990's, however, a paid executive director/association management firm has provided housing for the CMBA's office. At this time we have a modest website and are planning a phone line separate from that of the executive director.

| 3.0 Services | [back to top] |

Activities and events:

| 3.1 Service Description | [back to top] |

| 3.2 Alternative Providers | [back to top] |

While there are no direct competitors, there are other organizations that may solicit our members and prospects.

| 3.3 Printed Collaterals | [back to top] |

The management team will develop an organization brochure to explain the benefits of membership to prospective members and associate members.

| 3.4 Fulfillment | [back to top] |

| 3.5 Technology | [back to top] |

The executive director and the Association management team will maintain Windows and Mac capabilities including:

| 3.6 Future Services | [back to top] |

Among the services planned for the future are:

| 4.0 Market Analysis Summary | [back to top] |

There are more than 100 businesses in Connecticut involved with motorsports; from franchised dealers and independent accessory shops, repair facilities, and used vehicle dealers to insurance agencies, distributors, manufacturers, and other interested parties. In addition, there are potential associate members outside the state, such as manufacturers, distributors, insurance companies, and others who service and sell to our members.

| 4.1 Market Segmentation | [back to top] |

Market

Analysis (Pie)

| Market Analysis | |||||||

| Potential Customers | Growth | 1999 | 2000 | 2001 | 2002 | 2003 | CAGR |

| Franchised Dealers | -10% | 25 | 23 | 21 | 19 | 17 | -9.19% |

| Independent Shops | 0% | 50 | 50 | 50 | 50 | 50 | 0.00% |

| Associate Members | 20% | 25 | 30 | 36 | 43 | 52 | 20.09% |

| Total | 4.44% | 100 | 103 | 107 | 112 | 119 | 4.44% |

| 4.2 Target Market Segment Strategy | [back to top] |

Past experience has shown that most businesses in our industry will not join this association of their own accord. Instead, we must mount an aggressive membership drive.

NOTE: The number of franchised dealers is shrinking by mergers and acquisitions. Future growth of membership will require attracting the independent shops.

| 4.2.1 Market Needs | [back to top] |

For the most part, our members and potential members are very small businesses with limited resources for training and marketing. We can help them improve their earnings and increase the value of their investments with sales and management training and well as marketing information and marketing aids.

| 4.2.2 Market Trends | [back to top] |

One important trend is the hectic nature of our lives combined with increasing competitiveness in the marketplace, not just from our own industry, but from a wide range of products and services targeting our customers' dollars. In addition, mail order and Internet marketers also erode our market share.

A more positive trend is that new motorcycle and other powersports equipment sales seem to be increasing. Consumer confidence is up and so is consumer spending.

| 4.2.3 Market Growth | [back to top] |

According to the D.J. Brown Composite Index in Dealernews magazine, the motorcycle industry is celebrating its seventh straight year of expansion. And it's not just cruisers and sportbikes, the report continues, it's also touring bikes and dirtbikes. Street motorcycles, including cruisers, sportbikes, tourers, and standards are up 17% through the end of 1998. Today's retail sales produce more than 3.5 times the dollars produced in 1983.

In addition, Powersports research, also reported in Dealernews, stated that "56% of motorsports customers turn to their friendly neighborhood dealer for all of their routine service work."

| 5.0 Strategy and Implementation Summary | [back to top] |

CMBA will focus on three major projects: Winter Conference combined with Motorcycle Show, SuperRide, and Annual Awards Banquet.

Other revenue will come from monthly dinner meetings (profit on dinner plus sponsorship) and sale of advertising in the monthly newsletter.

| 5.1 Strategy Pyramid | [back to top] |

Our main strategy is the growth of membership. A large membership base provides revenue from dues and also positions CMBA as the true representative of the Connecticut motorsports industry.

The tactics to grow the membership are:

Programs to support these tactics are:

| 5.2 Value Proposition | [back to top] |

Our members operate with the knowledge and experience of many businesses over many years instead of trial and error. The opportunity to network with peers as well as industry and government leaders provides value far in excess of the cost of membership.

Our members share in the power of numbers when dealing with insurance carriers, distributors and manufacturers, and other vendors. They have the opportunity to tap into each others inventory for better customer service.

| 5.3 Competitive Edge | [back to top] |

Dealing with highly independent small-business owners requires an aggressive presentation of the value of membership to encourage prospects to spend their time and money with the Association.

Direct on-site presentations by the executive director (and possibly members of the Membership Committee) accompanied by presentation materials that clearly demonstrate value of membership will be used to reach membership size objectives.

Increasing the meeting schedule from twice-yearly to monthly always at the same location and same day of the month-–will enable more members and prospective members to attend more meetings. This will build fellowship and trust among competing businesses to raise the standards of the whole industry. In addition, upgrading the newsletter to a monthly publication–-along with fax and email notices-–will improve the flow in critical information and raise the awareness of the benefits of membership.

| 5.4 Marketing Strategy | [back to top] |

As shown by the Sales Forecast table and chart, the major sources of funding will each have its own strategic plan.

| 5.4.1 Positioning Statement | [back to top] |

The following table and chart give a run-down on forecasted sales. With a full-time executive director in place, we expect first-year sales to jump dramatically over previous years and then grow incrementally as membership and member services increase.

Revenue assumptions are based on past history plus adjustments for this new initiative:

| Funding Forecast | |||

| Funding | FY 2000 | FY 2001 | FY 2002 |

| Dues | $12,500 | $15,000 | $15,000 |

| Monthly Meetings | $6,000 | $14,000 | $15,000 |

| Motorcycle Show | $21,000 | $25,000 | $27,000 |

| SuperRide | $107,300 | $120,000 | $150,000 |

| Awards Banquet | $17,000 | $20,000 | $25,000 |

| Conference | $30,000 | $30,000 | $30,000 |

| Newsletter | $1,200 | $1,200 | $1,200 |

| Other | $0 | $0 | $0 |

| Total Funding | $195,000 | $225,200 | $263,200 |

| Direct Cost of Funding | FY 2000 | FY 2001 | FY 2002 |

| Dues | $150 | $200 | $200 |

| Monthly Meetings | $4,800 | $12,000 | $12,000 |

| Motorcycle Show | $19,000 | $20,000 | $22,000 |

| SuperRide | $74,700 | $80,000 | $100,000 |

| Awards Banquet | $13,500 | $16,000 | $18,000 |

| Conference | $15,500 | $17,000 | $17,000 |

| Newsletter | $900 | $900 | $900 |

| Other | $0 | $0 | $0 |

| Subtotal Cost of Funding | $128,550 | $146,100 | $170,100 |

| 5.4.2 Pricing Strategy | [back to top] |

Our fund-raising programs include monthly objectives with a financial bonus incentive to the executive director to exceeding each month's objective. The executive director will report to the president and the board of directors each month, and the officers and directors will communicate among themselves, either by meeting or telephoning (also fax or email), at least once a month. The executive director will conference with the president at least weekly.

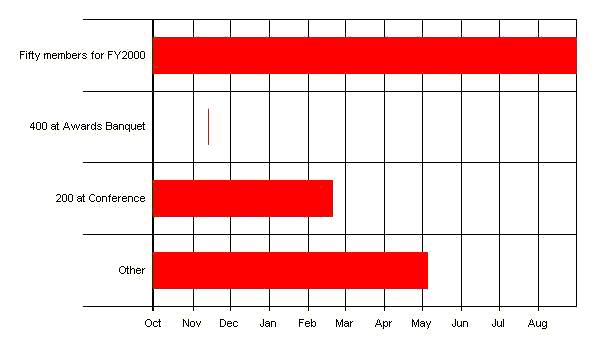

| 5.5 Milestones | [back to top] |

The accompanying table lists important program milestones, with dates, responsible parties, and budgets for each. The milestone schedule indicates our emphasis on planning for implementation.

What the table doesn't show is the commitment behind it. Our business plan includes complete provisions for plan-vs.-actual analysis, and we will hold follow-up meetings every month to discuss the variance and course corrections.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Fifty members for FY2000 | 9/30/1999 | 8/31/2000 | $12,500 | Essenfeld | Membership |

| 400 at Awards Banquet | 11/13/1999 | 11/13/1999 | $17,000 | D'Occhio | Banquet |

| 200 at Conference | 9/30/1999 | 2/20/2000 | $30,000 | Essenfeld | Events |

| Other | 9/30/1999 | 5/5/2000 | $110,000 | Essenfeld | Events |

| Totals | $169,500 | ||||

Milestones

| 6.0 Management Summary | [back to top] |

The initial management team consists of the board of directors and officers of CMBA working closely with the executive director. In addition, a professional lobbyist is employed to keep us appraised of legislative activities and to help us affect desired outcomes. Ultimately the work will be divided among committees and the executive director may need to add staff to the Association management team.

| 6.1 Personnel Plan | [back to top] |

The following table summarizes our personnel expenditures (executive director and lobbyist) for the first three years, with compensation increasing from about $43K the first year to about $59K in the third. We believe this plan is a good compromise between fairness and expedience, and meets the commitment of our mission statement. The detailed monthly personnel plan for the first year is included in the appendices.

| Personnel Plan | |||

| FY 2000 | FY 2001 | FY 2002 | |

| Executive Director | $39,000 | $44,000 | $53,000 |

| Other | $4,200 | $5,000 | $6,000 |

| Total People | 2 | 2 | 2 |

| Total Payroll | $43,200 | $49,000 | $59,000 |

| 7.0 Financial Plan | [back to top] |

| 7.1 Important Assumptions | [back to top] |

Notes for Sales chart for 1999-2000 (FY2000):

Revenues:

Costs:

| General Assumptions | |||

| FY 2000 | FY 2001 | FY 2002 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 0.00% | 0.00% | 0.00% |

| Other | 0 | 0 | 0 |

| 7.2 Projected Surplus or Deficit | [back to top] |

Our projected profit and loss is shown on the following table, with sales increasing from more than $195K the first year to more than $263K the third. Profits may be applied to legislative activities, marketing activities, or held for contingencies.

The detailed monthly projections are included in the appendices.

| Surplus and Deficit | |||

| FY 2000 | FY 2001 | FY 2002 | |

| Funding | $195,000 | $225,200 | $263,200 |

| Direct Cost | $128,550 | $146,100 | $170,100 |

| Other | $0 | $0 | $0 |

| ------------ | ------------ | ------------ | |

| Total Direct Cost | $128,550 | $146,100 | $170,100 |

| Gross Surplus | $66,450 | $79,100 | $93,100 |

| Gross Surplus % | 34.08% | 35.12% | 35.37% |

| Expenses: | |||

| Payroll | $43,200 | $49,000 | $59,000 |

| Sales and Marketing and Other Expenses | $1,380 | $6,400 | $7,450 |

| Depreciation | $0 | $0 | $0 |

| Rent | $6,000 | $6,500 | $7,000 |

| Rent | $0 | $0 | $0 |

| Telephone service | $1,200 | $1,500 | $1,800 |

| Utilities | $0 | $0 | $0 |

| Payroll Taxes | $3,888 | $4,410 | $5,310 |

| Other | $0 | $0 | $0 |

| ------------ | ------------ | ------------ | |

| Total Operating Expenses | $55,668 | $67,810 | $80,560 |

| Surplus Before Interest and Taxes | $10,782 | $11,290 | $12,540 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $0 | $0 |

| Net Surplus | $10,782 | $11,290 | $12,540 |

| Net Surplus/Sales | 5.53% | 5.01% | 4.76% |

| 7.3 Projected Cash Flow | [back to top] |

Cash flow projections are critical to our success. The monthly cash flow is shown in the illustration, with one bar representing the cash flow per month, and the other the monthly balance. The annual cash flow figures are included here and the more important detailed monthly numbers are included in the appendices.

Cash

| Pro Forma Cash Flow | |||

| FY 2000 | FY 2001 | FY 2002 | |

| Cash Received | |||

| Cash from Operations: | |||

| Cash Funding | $195,000 | $225,200 | $263,200 |

| Cash from Receivables | $0 | $0 | $0 |

| Subtotal Cash from Operations | $195,000 | $225,200 | $263,200 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $195,000 | $225,200 | $263,200 |

| Expenditures | FY 2000 | FY 2001 | FY 2002 |

| Expenditures from Operations: | |||

| Cash Spending | $13,713 | $16,050 | $18,635 |

| Payment of Accounts Payable | $168,948 | $197,595 | $231,731 |

| Subtotal Spent on Operations | $182,661 | $213,645 | $250,366 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $182,661 | $213,645 | $250,366 |

| Net Cash Flow | $12,339 | $11,555 | $12,834 |

| Cash Balance | $24,339 | $35,895 | $48,728 |

| 7.4 Projected Balance Sheet | [back to top] |

The balance sheet in the following table shows managed but sufficient growth of net worth, and a sufficiently healthy financial position. The monthly estimates are included in the appendices.

| Pro Forma Balance Sheet | |||

| Assets | |||

| Current Assets | FY 2000 | FY 2001 | FY 2002 |

| Cash | $24,339 | $35,895 | $48,728 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $24,339 | $35,895 | $48,728 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $24,339 | $35,895 | $48,728 |

| Liabilities and Capital | |||

| Current Liabilities | FY 2000 | FY 2001 | FY 2002 |

| Accounts Payable | $1,557 | $1,823 | $2,116 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $1,557 | $1,823 | $2,116 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $1,557 | $1,823 | $2,116 |

| Paid-in Capital | $0 | $0 | $0 |

| Accumulated Surplus/Deficit | $12,000 | $22,782 | $34,072 |

| Surplus/Deficit | $10,782 | $11,290 | $12,540 |

| Total Capital | $22,782 | $34,072 | $46,612 |

| Total Liabilities and Capital | $24,339 | $35,895 | $48,728 |

| Net Worth | $22,782 | $34,072 | $46,612 |