23 March 2009

Last week, the Federal Reserve took yet another step in easing monetary policy and fighting the credit crisis. It is a step, however, that is not without risk.

On 18 March, the Federal Open Market Committee (FOMC) announced that, to help improve conditions in credit markets, the Federal Reserve will purchase longer-term Treasury securities over the next six months. This is a departure from its usual policy of buying only short-term securities.

The obvious impact of this move will be to depress yields on longer-term Treasuries. Indeed, on the day of the FOMC announcement, the yield on the 10-year note fell 47 basis points, the most since January 1962.

The Fed's purchase of longer-term Treasuries allows it to provide more effective monetary stimulus and is expected to have at least some positive effect in promoting lending and economic growth and staving off deflation.

One side effect of the move, though, is that the yield curve, or the spread between long-term yields and short-term yields, will no longer be a reliable indicator of the economic outlook. By pushing longer-term yields down, the move will tend to narrow the spread between those yields and short-term yields, flattening the yield curve. In normal times, a narrower spread would indicate deterioration in the economic outlook. With the latest Fed policy, however, the latter would no longer be the case.

Nevertheless, the yield curve may still be able to tell us something about the near-term future of the United States economy. Why? Because it usually forecasts the economy several quarters in advance. That is, the near-term outlook for the economy can be assessed using past yield curve when it was not affected by the latest Fed policy.

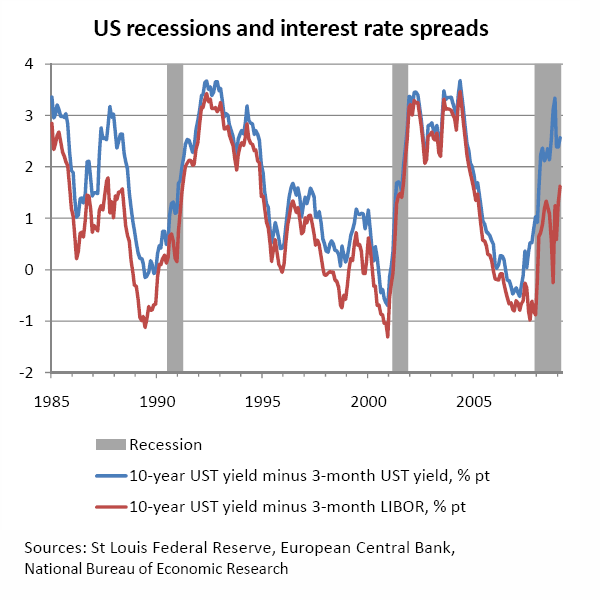

In February and early March, the 10-year Treasury yielded around 2.9 percent while the 3-month Treasury yielded around 0.3 percent. That gives a spread of about 2.6 percentage points.

In past recessions, by the time the spread between the 10-year yield and the 3-month yield had risen to this level, the recession was either close to or already at an end. For example, in the prior recession in 2001, the spread rose to this level in November, right at the end of the recession.

This suggests that the Fed has introduced its latest policy to buy long-term Treasuries to improve credit markets at a time when the recession is already close to or at an end.

One could argue though -- and quite correctly -- that today's recession is different from most past recessions because a credit crunch is aggravating monetary conditions. One way to better account for the credit crunch is to use the spread between the 10-year Treasury yield and the London interbank offered rate (LIBOR) for three-month US dollar loans rather than the spread between the 10-year Treasury yield and the 3-month Treasury yield.

However, even this measure provides a relatively optimistic forecast. While the difference between the 3-month LIBOR and the 3-month Treasury yield had surged to well over 4 percentage points in October last year, credit markets have improved since then to the extent that the spread has now fallen to around one percentage point.

As a result, the spread between the 10-year Treasury yield and the 3-month LIBOR had risen to around 1.6 percentage point in February and early March. Again, in past recessions, by the time this spread had risen to this level, the recession was either close to or already at an end. For example, in 2001, the spread rose to this level in September, just two months before the end of the recession.

It is probably premature to say, based on term spreads alone, that the recession is coming to an end. Bank balance sheets and financial systems remain impaired, so normal lending growth is unlikely to resume in the near future and even the LIBOR-based spread may not be providing a reliable forecast of the economy.

Still, the longer-term risk of excessive monetary stimulus must not be ignored. While the Fed's move last week to buy long-term Treasuries is aimed at alleviating short-term deflation concerns arising from the recession and credit crisis, it also has the potential to stoke inflation over the longer term.

One thing the recent past should teach us is that inflation prevention must not be ignored even in the midst of a near-term deflation threat. Back in September 2001, in the wake of terrorist attacks on the US homeland that threatened to negatively impact spending and economic growth, the Fed had cut interest rates by 50 basis points, lowering the target federal funds rate to 3 percent. Subsequently, with inflation apparently tamed, the Fed focused on fighting deflation instead and continued to ease monetary policy for another two years, the federal funds rate finally settling at 1 percent in 2003, by which time spreads between the 10-year Treasury yield and short-term yields were well over 3 percent. The sustained monetary easing was to eventually stoke a credit bubble that culminated in today's financial crisis.

So hopefully, the financial crisis has taught the Fed that even as it fights the short-term deflation threat, it must keep one eye on longer-term inflation potential. And it must now do so without the benefit of the yield curve as an early indicator since its move to buy long-term Treasuries will distort that indicator.

If the Fed fails to keep the necessary balance between short-term and longer-term concerns, we may yet see history repeat itself.

Disclaimer: The commentaries posted here represent the opinions of the author at the time of posting and should not be taken as investment advice. Readers who wish to take any investment action based on information obtained from this site should seek appropriate advice from a qualified financial adviser.