|

Spotting The Trend & Timing Entry/Exit Points - page 2

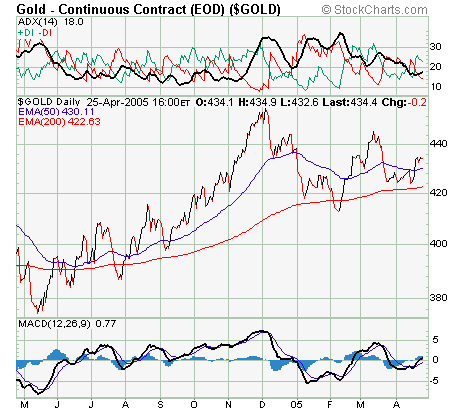

We began here with this 04-02-2005 'snapshot' of the global market in gold metal.

Note that the (long blue)

uptrendline was a straight line drawn upward and to

the right below the reaction lows. The longer the uptrendline had been in

effect and the more times it has been tested, the more significant it had become.

We were aware that violation of the trendline usually signals that the trend may be changing

direction.

10 weeks later, after a bloodbath, we now like like the ADX and DI

signals of this

chart and the MAs are OK with MACD not too bad either, so we're taking another long position in metal to add to that we

entered at $414 in early Feb - the clever clogs will have aggressively

traded the intervening volatility, but not us conservative canny trainee

trend traders.

Where's XAU? Answer is nowhere

worth doing anything about. The miners are

still getting hammered by a $ driven manipulated market.

Update

8AM GMT 27-04-05 : Some clever clogs aggressives will have

bought into XAU yesterday 26th. Not us canny lot. Why? NEM is going to

open today well down because of an after (American) hours report. As

the biggest miner it will drag the index down. Is the lesson (about

waiting for the correct signals set) sinking in?

Update : Here's the end of same (American) day XAU chart to drive the point

home.

A point worth mentioning is that from here on, miners are in for a very

tough time, or this is or will trigger, the capitulation that mining

stocks need to make a fresh start and get back into a positive trend......

04-05-05

This is not even a tradable bounce to conservative trend traders - look at

XAU's

ADX and DI signals set - you should by now be able to read it as one

significant indicator of traders' behaviour.

Lacking the sophisticated tools and other vast resources and connections

of the finance houses, what does a canny trend trader do? S/he effectively

trades the behaviour of those who have them! Why? Because herd behaviour

is a self fulfilling prophecy, some would say it *is* the markets and that

market manipulators are effective/expert herders

Experience/training develops 'nose' (your reading of a signals set

including ADX) for differentiating herd behaviour from direct market

manipulation.

18-05-05: Metal is still going nowhere (though we didn't have to close positions

opened at 414 in Feb)

18-05-05 : Neither is XAU - you should be able by now to that from XAU alone -

though aggressives have done nicely shorting it.

18-05-05: Therefore since this is about trend trading , instead of

waiting for gold metal and/or miners to resume uptrend, or for a trend

reversal downwards, we'll

re-focus on ETF QQQQ.

We'll watch it for day or so to develop 'nose'

about whether it is about to pullback to back-test the 200 EMA (when/where there could be an optimal

entry point).

24-05-05 : that gap up is not something to chase until ADX shows the

conditions we want.

QQQQ is equally dicey - ADX is confirming

what 'nose' is telling us, that the Qs could easily either continue advancing,

or pull back (and there will be a pullback sooner rather than later) towards

a better entry point near 50 or 200 EMA support. Therefore we're not going

to go long. What we could do (in either or both XAU and QQQQ - and it's about time that the topic/strategy was

introduced) is go long *and* short with Leap 'covered call' Options

(explanation when time permits).

In further explanation, the Qs ADX and other signals are very good

indeed - too good for entry in 'naked' (unhedged) long form. Had we been

focussed on the Qs earlier, we'ld have entered long (naked, or

unhedged) at the point in this chart when after +DI had crossed -DI

northwards or positively, DAX turn up indicating a strengthening positive

mini trend. But since we missed that entry point, we are *not* going to

chase after it. We will instead plan a more canny strategy.

6/06/2005 HUI ( a miners index) price has finally found

the weekly 200ema support. We've been waiting for something like this

since beforfe hen2005 bloodbath, in fact since a major correction began in

late 2003. In the next few days, aggressive traders will get set ups to

buy individual gold stocks, risking 2 to 3% for a possible return of

100%+. This is not a typo, it happened in 2002 and 2003.

12-06-05 : metal has broken above the $422 level after holding above

our $114 entry level. This is a serious upside breakout. It rose to $427

and then pulled back to $423 to retest the solidity of the breakout.

Friday's surge to $427 then triggered a significant upside move, probably

to $485 o above by the end of 2005.

As gold was breaking above $422, silver price confirmed the upside by

also breaking out of a triangular pattern which held the price in check

for the past year. Platinum price is another indicator. A move above the

major resistance at $880 will trigger a move to $1000. The precious metal

markets generally are brewing up.

There are indications of a serious bear market in equities. Perhaps

this is what the precious metals are anticipating.

140605 : gold Commercial Net Shorts has increased to 67k this week,

confirming the major bottom in metal. CNS should continue to rise as

speculaters return to the market, meaning higher bullion prices.

16-06-06 : XAU chart corroborates (refer to earlier coverage of ADX) -

and metal ETF GLD is about to do the same. For shorter term traders whose

'windows' to the markets are 60 min charts and less, its already there, but not for

us canny trend traders.

Why? Because we leave the technical complexities of

trading (manipulated) markets to the finance houses and their friends in

crony capitalist government circles - and we trade their (herd) behaviour.

Where are we at 21-06-05? We have the long position entered at 414 a

lesser one at 422 and a third also at 422 as +DI crossed -DI northwards

(lesser because of a weak ADX). Now despite the worry that gaps do get

filled eventually, there is a fourth entered when metal pulled back to 434

today, with ADX well north of a descending -DI and still howing a rising

mini trend.

A weather eye will be kept on ADX/-DI/+DI if the gap narrows much more and

ADX downturns, we'll smartly get out of the last position and

re-enter at a better price. Why? The answer's the same, it's because the

canny trend trader trades sheeple behaviour (without forgetting that the

flock can be suddenly startled and become completely unpredictable for a

while).

The gold and silver miners index XAU looks less robust with a

weakening ADX and a closing +/-DIs gap. Canny trend traders want to see

indication that the crowd has made up its collective mind about whether to

drive pullback to 50 EMA, or further advance. 50 EMA, or a northward

crossing thereof with ADX black line positively crossing the red -DI line, would be a sound

entry point.

26-06-05 : To read the independent market prognosis of a respected canny trend trader click HERE

- it's evident that there will be a pullback (nothing goes either up or

down in a straight line and the recent rise in metal price left a gap that

will eventually be filled), but the timing and extent are in dispute.

05-07-05 : The ADX/+DI/-DI graph for metal says it all

and you should by now be able to interpret the story without assistance.

Will our basic 414 entry position be threatened as the others were?

Meantime in a nice illustration of the fact that a miner's stock price

doesn't always reflect metal price movements only, the XAU miners' index

looks less weak although ADX is weakening indicating a weakening mini

trend.

The metal seems to be getting good support at the 200 EMA

line and the -DI plus negative trending ADX combo is weakening.

We canny and patient trend traders hold and wait for positive

indicating crowd behaviour in relation to the narrow segment of the

market (metal and miners) on which we are focussed in order to keep this

tutorial manageable. Polytechnic bandwidth, that has made the larger

pics with which this module kicked off too 'fat', is being borne in mind

and may dictate a complete rewrite, but meantime can be worked around by

saving the first page (and this one too if necessary) very early AM

and/or Saturdays - and viewing it offline.

By 12-07-05 the miners index XAU a nice ADX / +DI / -DI signals set

telling us that there is the kind of crowd behaviour that we trade. To

complete the perfect entry point picture we would like to see EMA50

cross EMA200 positively, BUT there is consolation in the fact that

EMA23 has crossed EMA50 in positive direction. So what do we do? We

don't have our perfect setup with a full positive signal set (EMA would

be less significant if we had a definite thrust of ADX northwards across

a falling -DI, indicating a stampede by the herd). Work it out - you

should by now be able to make some decisions unaided.

Has the lesson been driven home? Consider why you were not advised to

take the plunge into the miners index, on the basis of the above mixed

signals. We now wait for a bounce from EMA50, plus a definite positive

reversal of +DI/-DI, plus firmly positive ADX - it could go either way

from this point - a positive 50EMA cross of 200EMA would confirm the

picture of herd behaviour. 15-07-05

Metal is a puzzler. There's a hunch (no more) based on experience, that

it has bottomed but signals set confirmation is awaited - and , 'bottom'

could only be in a short-term sense (possibly presenting the opportunity

of a tradable bounce/mini-rally/mini-trend). Meantime, at least our

solid 414 entry point (position taken the second last time, as can be

seen from this chart, that GLD dipped below 200EMA) isn't threatened

yet.

The above snapshot charts for 11th and 15th Aug 2005 are easily read

against background of our metal entry at $414 - however, what passes for

broadband at the polytechnic has degraded to such an extent that this

material lo longer loads at kpoly terminals during working hours.

to be contd.............

Update 19-08-05 : This action research cycle is slowly grinding to a halt in the

face of 'education' establishment hostility (rooted in and perpetuated by the

fact that nobody is getting 'dashed' to facilitate free 21st century net

mediated education), and related gradual degradation of what was a mickey mouse

'broadband' service to begin with.

At this time, a project manager or student at Kpoly, can for

example only occasionally access a Yahoo mailbox, almost never

access Google Groups, very seldom access his/her (Yahoo)

Geocities personal web site to maintain/develop it, use of

VideoSkype has become completely impossible even at weekends,

and the graphics that are an essential component of

http://kumasipolytechnic.net/kpolytrendtrade2.htm for

example will not load, etcetera.

Update 09-12-05 : Following some months of 'improvements' to and

'upgrading' of the campus internet interface, the situation is

completely unchanged and the cost of decent bandwidth is still being

'invested' in rusty Mercedes, extra wives et cetera, and the foreign

bank accounts of those who have them among beneficiaries of 'aid'.

Our teaching programme, if facilitated, would by now have

reached the following trend trading stage :

09-12-05 :

PAAS is an excellent example of why

you should use "LEAP" Option contracts instead of the shorter term

variety. Look up in page one, the entry point and LEAP contract (VZZAD)

that was selected.

There followed something of a temporary bloodbath, followed in turn

by a strong recovery, so that at this time the position can be exited at

a substantial profit, whereas a shorter term contract would

have been a total loss if held for long enough.

Btw, if you want the advcie, now is the time to take a breather and

some profit, so that you can re-enter at a significantly lower price

and/or later contract expiry date.

As can be seen from the charts, the values of gold metal, $GOLD, and

precious metals miners shares, have surged. So much so that if we were

still in real-time teaching mode, you would be strongly advised to

reduce your holdings immediately, to zero in metal, and perhaps 25% in

the miners shares index $XAU. It is to be hoped that you are by now

experienced enough to see why. Nothing goes up forever and there will be

a pullback towards if not all the way down to, the 200 EMA line. Exiting

now will enable the 'banking' of profit and re-entry at a considerably

lower level. Those who are stimulated by living dangerously will stay

'in', while watching the indicators like hawks, and hopefully not

get singed. Remember! We canny trend traders are effectively traders in

herd behaviour. However, it's sometimes possible to anticipate/predict

what the herd is going to do before it happens. Good luck! Pity the net

connectivity is so lousy.

As can be seen from the charts, the values of gold metal, $GOLD, and

precious metals miners shares, have surged. So much so that if we were

still in real-time teaching mode, you would be strongly advised to

reduce your holdings immediately, to zero in metal, and perhaps 25% in

the miners shares index $XAU. It is to be hoped that you are by now

experienced enough to see why. Nothing goes up forever and there will be

a pullback towards if not all the way down to, the 200 EMA line. Exiting

now will enable the 'banking' of profit and re-entry at a considerably

lower level. Those who are stimulated by living dangerously will stay

'in', while watching the indicators like hawks, and hopefully not

get singed. Remember! We canny trend traders are effectively traders in

herd behaviour. However, it's sometimes possible to anticipate/predict

what the herd is going to do before it happens. Good luck! Pity the net

connectivity is so lousy.

ETF GLD, $GOLD .......

09-12-05

and the miners index

XAU, all behaving similarly......

Until the greedy rush runs out of steam, the herd panics........

..... and there is a mad scramble for the exit, in a nice and timely illustration of why

we trade herd behaviour (see the 09-12-05 advice to get out).

16-12-05 :

We now want to see if GLD will bounce from one of the EMAs (50 and 200),

or one of those gaps around 47.5, for a possible re-entry point with

positively indicating

ADX and DI signals and CMF (Money

Flow).

If it happens, then it will give us a nice tidy action research cycle

'rounding' event, in the face of subversive opposition from 'aid'

dependant neocolonialist forces and in demonstrative proof that if we can do it

(trade through what has been a difficult year, with a comfortable

year end profit margin), free from 'aid', then anybody can.

Our re-entry at GLD's EMA50 has paid nicely, but beware the new gap -

when it is filled and it will happen sooner or later, then GLD may again

retrace back to EMA50 / EMA200 / earlier_gap(s) around 47.5. Maybe we

should again 'cash in' and see what happens over the New Year break, if

only because with so many people out of the market, the numbers

remaining in make trading herd behaviour quite perilous. We'll watch

closely today 29th and if GLD drops below EMA50 on a two day 15

minute interval chart, then

we'll 'bank' the bounce. At any rate, the tradable 'bounce' has nicely rounded off our teaching (by

real-time action research) and your 'learning by doing' (gold_metal/miners_stock

trading), year.

One final thought : use of terms like 'bounce' are determined by

existence of gaps that usually get filled - on the other hand looked at

on a different time-scale, gold is still in a secular uptrend, so

you could just ignore relatively short-term volatility like the above,

as long as either your money management technique is sound enough to survive

significant 'draw-down' from time to time, or you're very light-footed

and consequently in cash during periods of high 'draw-down' risk - the

latter can be done as we illustrated in real-time (above) but you need a

combination of both techniques in case you get one wrong.

Repeat : you may advise your clients to 'buy and hold' the metal and miners'

index for quite some time ahead, *but* only those who can withstand

considerable temporary 'drawdown' - the very steep (and ongoing) rise in

the market value of the metal and miners' index

XAU) at year end is illustrated

here (in Euros,

meaning nothing at all to do with long-term devaluation of the Bush

dollar), *can* be matched by equally ferocious temporary 'drawdown'.

A broad view of the gold market and general market intelligence can be

viewed here.

NB : As soon as the US markets opened, not only did spot gold

and GLD go through the (two day, 15 minute interval) 50EMA, but it went

through the 200EMA also. Let this be a lesson in money management

vis-a-vis the ability of crony capitalism to manipulate relatively small markets and

crash through people's ability to withstand volatility/drawdown.

Needless to say, we're OK because we saw it coming. But this afternoon there

are some who are wiped out and others who are hanging in there by their

fingernails, in the last bastion of red in tooth and claw capitalism. Take note and internalise ! You could say,

taking a broad view,

that a useful lesson is taught by the above as an illustration of the

adage about a fundamental flaw of capitalism that is heightened/exposed at a time

like this when many are out of the market - it tells us that when there

are too

few capitalists, there cannot be a free market, free from

manipulation/domination. From our narrower trading perspective, we are

lacking the massive herd behavioural homogeneousness that we trade - and

as canny and successful trend traders, we ain't going to go all

adventurous all of a sudden and throw away our proven and tested

principles and techniques.

|

![[24 hr gold spot]](http://www.kitconet.com/images/live/s_gold.gif)

![[24 hr silver spot]](http://www.kitconet.com/images/live/s_silv.gif)