Some make you laugh. Some make you angry. But they all give

you that "shake your head in amazement feeling" and

make you wonder if they really believe what they said.

Regarding the bribery surrounding the pardons:

The bromide "we learn from our mistakes" gets a real

test here: Bill Clinton

"The children of this country can learn in a profound

way that integrity is important and selfishness is wrong, but

God can change us and make us strong at the broken places. I want

to embody those lessons for the children of this country—for

that little boy in Florida who came up to me and said that he

wanted to grow up and be President and to be just like me. I want

the parents of all the children in America to be able to say that

to their children."

"The children of this country can learn in a profound

way that integrity is important and selfishness is wrong."

Bill Clinton at the annual White House prayer breakfast for

clergy Washington, D.C. September 11, 1998, soon after his grand

jury testimony concerning his multiple felony charges.

2/6/2001

Tom Daschle

"This is a brand new 2001 Lexus GS 300, fully loaded, with

every luxury option available - just like the Bush tax cut. If

you're a millionaire, under the Bush tax cut, you get a $46,000

tax cut—more than enough to pay for this Lexus. But, if you're

a typical working person, you get $227—enough to get a new

muffler for your car. And if you make $25,000 a year, you get

a goose egg."

Mr. Daschle, is that "typical working person" an employee

of that millionaire? Or, is that "typical working person"

an employee of some other typical working person?

I did not have to dwell on this question too long, Tom, but it

seems to me that the high income, high taxed taxpayers create

a lot of jobs for those "typical working" people.

It also seems to me that in order to be a high taxed taxpayer,

there is a better than even chance that they are pretty smart.

Do you know what will happen when enough high taxed taxpayers,

who are generally pretty smart, realize that the top 25% of wage

earners pay 80% of the taxes?

The morale of these folks will be drained to the point that their

Lexus ends up with a hole in the muffler and the owner just does

not have the incentive anymore to replace it.

What you should be doing, Tom, is instilling the desire to train

and educate the low taxed taxpayers so they can move up from the

rusted out 1978 Pinto with a hole in the muffler to a new Lexus.

They should have a dream of one day owning a nice car and a nice

home. Motivate them Tom, don't encourage them to have a very low

income by rewarding them with less and less taxes the more their

income drops.

I say don't cut the taxes on the lowest income wage earners;

that will help motivate them to get better training and education

to move up the ladder. Besides, the tax structure today is grossly

unfair to middle and high income earners.

With your plan, Mr. Daschle, you will soon have to find enough

citizens with shoddy mufflers to pony up enough money to buy the

next billion dollar fiber optics facility because the high taxed

taxpayers are so demoralized that they choose to become lower

taxed taxpayers. Get the picture?

One more thing, Tom. Fix your web site. It

is broken. It is in bad need of repair. It has internal damage—just

like your leadership.

Sen. Tom Daschle (D-SD) is chairman of the Democratic Policy

Committee and you can view his broken down,

neglected, non-functional web site here.

E-mail

Sen. Daschle

2/14/2001

CNN Crossfire

Rep. Harold Ford, Jr. (D-TN)

When asked about the bribery/pardons corruption and the investigations:

"But I think they're more outraged that

we're continuing to investigate, investigate and investigate."

Harold,

I think I will chalk up another reason why Tennessee thumbed their

nose at Al Gore this past election. Harold,

I think I will chalk up another reason why Tennessee thumbed their

nose at Al Gore this past election.

E-mail

Harold Ford, Jr.

|

|

|

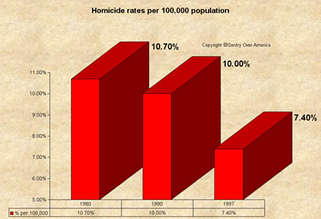

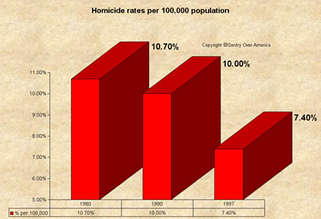

What does the above chart

have in common with the chart below?

Another Clinton lie you ask?

Between slinging White House furniture on

the U-Haul, arranging kickbacks for pardons, and plotting

how to upstage George Bush's inaugural day, King Corrupt had

the White House issue a twenty four point list of "accomplishments"

that he wanted to snatch from the rightful ownership of others

called "The Clinton Presidency: A Historic Era of Progress

and Prosperity."

Read

Article page 2

|

Slave State

The Other Side of the Ledger

Friday, February 23, 2001 700 p.m.

How successful would General Electric have been

if Congress was their management team for the past thirty

years? Not too, I submit.

Congress acts as though expenses make up the

only part of the income statement. All we ever hear is spend

on this, increase spending on that. And Congress never cuts

spending like you and I do. To even slow the rate of increase

in a spending program causes a filibuster.

There is another side of the ledger. It is income.

It is our tax dollars. And Congress never is serious with

that side of the ledger as they feel it is a divine right

stream of endless dollars for them.

Did you get upset when the vandalism of Air

Force One and the White House was blown off? It will take

two single people having roughly $30,000 of taxable income

each 30 years to pay for the White House damage. How would

you like to be singled out and told every dollar of taxes

you pay for the rest of your life will be used to pay for

the White House damage. If you truly hate Hillbilly Slick

Willie, how much would you enjoy your job then? A couple unknown

and randomly assigned taxpayers will be doing exactly that.

Call them Jane and John. Have fun, y'all.

The President and others blew this off because

Washington never looks at the other side of the ledger with

a personal touch. What do they care about 200 thousand here

and 48 million there when the budget deals in billions? What

about the Marc Rich 48 million or so of tax evasion? It will

take about 325 single people with $30,000 of taxable income

30 years to pay for this lost revenue.

Memo to Congress—there are two sides to

the ledger and you must get serious with our money.

Now, about those expenses.

Corporate America makes decisions based on the

best interest of their shareholders. That is because shareholders

have votes equal to shares owned.

Some members of Congress make decisions based

on the best interest of some members of Congress. That is

because one middle income taxpayer with only one measly vote

often pays as much taxes as all the people that can fill the

local arena who pay no or little taxes. Only after the next

"American Revolution" will we have voters with the

number of votes equal to the tax dollars paid by each.

In the free enterprise system, companies search

for every possible revenue source. Then, they manage their

very best to cut expenses as much as possible. The goal—profits.

Our government is a "not-for-profit"

organization, at least, until recently. Our government should

do the opposite—search for every possible way to reduce

the taking of citizens money (reduce revenue) and manage their

very best to use budgeted money to meet the expenses. The

goal—a balanced budget.

The liberals use this approach: search for every

possible expense to puff up, search for every new wasteful

program to grow, overlook outdated and inefficient management

teams and then bloat the expenses up to suck away any current

profits (projected surplus). Their goal—increase the

size of government so as to increase the size of their constituency.

In recent days, we have heard of thousands of

layoffs from dozens of companies as managers adjust expenses

for a slowing economy. Some divisions will be closed down.

Lucent is spinning off one division and selling another.

When was the last time some hours were cut back

on government employees due to a slowing economy? Have you

heard in the news of any government employee layoffs? Salary

reductions? Reduced budgets? A cut in capital expenditures?

Whatever happened to that spinoff of the Energy

Department floated back in 1994? Or the shutdown of the Department

of Commerce? Where have you gone, Newt Gingrich?

American prosperity has been achieved in spite

of the terrible waste that the government breeds. How much

more personal success would Americans have if our government

was managed with cost controls and efficiency standards? If

we gave 100 top CEOs of corporate America free reign to manage

in the best interest of the citizens, we could increase payments

into various social programs, reduce taxes, and eliminate

the debt, and repair our broken military.

Why? Because managers manage the ledger. Politicians

manage opinion polls.

"Equally important, the 2,478 cost-cutting, revenue-enhancing

recommendations we have made can be achieved without raising

taxes, without weakening America's needed defense buildup,

and without in any way harming necessary social welfare

programs."

That was a quote from J. Peter Grace who Ronald

Reagan commissioned to find waste and abuse in the Federal

government circa 1981. Tell me, what percentage of these Grace

Commission recommendations ever got implemented? Do you think

Maxine Waters and her socialist cronies even know who J. Peter

Grace was? Do you think Mad Max cares?

Reagan had the right idea. Dan Rostenkowski

had the right power. So, nothing got done.

Twenty years later—the focus is still on

spending money, not on government management skill.

Until we have fiscal management at the top of

the priority list of the citizens, we will continue to be

slaves of the government. The next time you see the same ol'

polls of voter concerns, you will never see fiscal discipline

even ranked. Instead of having concern for the morale of the

taxpayers and the health of the country, the voters' radar

screens are cluttered with the typical "how much are

they spending for my favorite issue."

Their money is not one of their favorite issues.

And so, the ghost of Karl Marx smiles today

as the liberals grin with glee.

|

|

|

Tired of the centrist mumble? Here are some refreshing comments

straight from the"tell it like it is" school.

Comments from the Columnists on Tax Policy:

Linda Bowles

"It is morally wrong to allow non-income taxpayers to vote

to raise the income taxes of others—and benefit from doing

so. It is morally wrong in this sense: While most Americans would

never dream of seizing money or property that belongs to a neighbor,

many Americans see nothing wrong in giving government and politicians

a mandate to do it for them."

Steve Chapman

"How do people respond to confiscatory taxation? They work

less. They consume rather than save. They invest with an eye toward

reducing their tax burden, even if it doesn't make much economic

sense. Only a small percentage of people have to react in these

ways to sap the efficiency and output of the entire economy—a

result that is bad for the rich and no favor to the poor."

Mona Charen

"Democrats, as we know, believe that all money belongs

to the government—which is why they refer to "spending" money

on a tax cut."

Mona, you truly hit on the most astounding quirk of the American

psyche. We think we relish freedom, yet we act desensitized to our

taxing slavemasters.

How else do you explain the silence when a liberal talks about

"spending money on a tax cut?"

Here is a quote form Al Gore in his opening comment in the first

debate:

"I believe it's important to resist the temptation to

squander our surplus. If we make the right choices, we can have

a prosperity that endures and enriches all of our people."

Now if you watch a tape of that debate and look at the audience,

you never even saw a head move nor an eye batted when Gore said

that. Mona, if you and I were in the audience, we would have levitated

off our chairs.

Jim Leher looked like a zombie with narcolepsy when Gore said that.

Imagine. "Resist the temptation to squander our surplus."

In Gore's world, you can squander future taxes not yet received.

These are taxes above and beyond budgeted expenditures, yet Gore

feared we would "squander them" by returning them to the

taxpayers.

In Gore's liberal land, excess future tax revenue is "ours",

i.e., the government's. And this "enrich all our people"

is using excess confiscated future revenue as transfer payments—take

from the haves, give to the want to haves.

Only a socialist could say a reduction in future revenue is an

expense item. That is like a factory worker who requests to work

less overtime next year; is that spending money today to reduce

his future income? Say what? This is coherent only to a liberal.

My college accounting professor would have blown a gasket if a

student's answer was "expensing today future revenue."

Double entry bookkeeping? More like double entry dumbness.

Only in liberal land, Mona.

Brent Bozell

"It was George Bush I's famous battle cry of "Read My Lips:

No New Taxes" that won him the presidency in 1988. For two years

thereafter the drumbeat of media opposition to that pledge was merciless.

It was reported as fact, over and over again, that the deficits

were the root of all fiscal evil, and Reagan's tax cuts the cause

of the deficit. In fact, in 22 major network reports on the deficit

in 1990, all pointed to the need for higher taxes. Not one saw fit

to suggest that perhaps the insatiable appetite for new federal

spending was the cause, with a fiscal diet in order for Congress."

Thanks for the accurate historic recap, Brent. Since Dan Rostenkowski

was pardoned by King Corrupt, I hope he had a chance to read your

column.

Doug Bandow

"Moreover, as a percentage of GDP, the Bush plan is only half

the size of John F. Kennedy's rate reduction and one-third the size

of Ronald Reagan's tax cut. Bush would provide less relief than

was pushed by congressional Democrats in 1981, according to Eric

Schlecht of the National Taxpayers Union."

So right, Doug. We need a much bigger tax cut than what Bush proposed.

Cut the waste and fraud and the useless fat bottomed girls then

install some new technology—no problem.

Cal Thomas

"Cut spending, along with taxes."

If only we did not have socialism, Cal.

Comment on equality and objectivity:

Larry Elder

"Someday, many of their critics will apologize. Who am

I talking about? Two economists, who happen to be black, Thomas

Sowell and Walter Williams. . . OK, if not an apology, how about

a well-deserved round of applause?"

My hands have been chafed raw at times for applauding, Larry. I

do hope we see more of the fine black conservative economists and

commentators, like you, in the next four years. And, hopefully,

less of the Al and Jesse show.

|

Harold,

I think I will chalk up another reason why Tennessee thumbed their

nose at Al Gore this past election.

Harold,

I think I will chalk up another reason why Tennessee thumbed their

nose at Al Gore this past election.